ProFlex® is designed to optimize your time, ignite your investment IQ, and maximize your financial potential.

Proflex Market Update - Wk 15

|

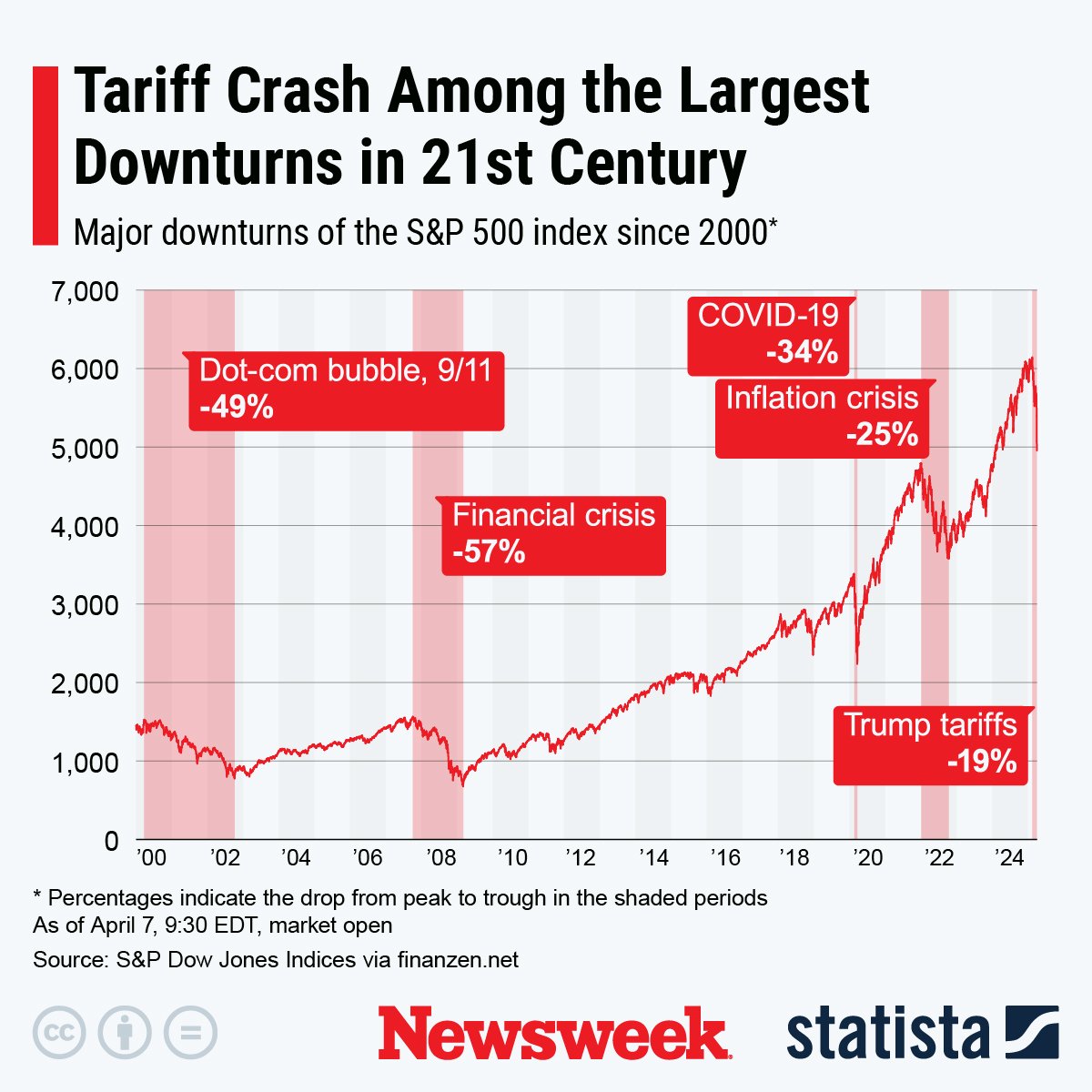

Proflex Market Update - Wk 15 Welcome to another weekly update from Proflex! A lot has happened in the last week. While many anticipated Trump to use tariffs and the April 2 deadline merely as negotiation tactics, potentially stepping back with minor concessions, he instead demonstrated a clear intent to redefine the global geopolitical landscape. Markets reacted dramatically, plunging by over 10%, marking the worst weekly decline since the COVID crash. This was nothing short of a bloodbath across the board, with investors left grappling with unprecedented uncertainty. Navigating the Storm Markets took a devastating hit last week as the U.S.-China trade war escalated beyond anyone's expectations. As we anticipated in our previous update, Trump has firmly declared an economic war on China, explicitly stating that all negotiations are open—except on tariffs against China. Markets reacted swiftly, plunging by over 10%, marking the worst weekly decline since the COVID crash. It was nothing short of a bloodbath across the board.

Short squeezed by rumors Yet, amid the chaos, market shorts experienced a roller-coaster ride yesterday. A fake tweet suggesting a 90-day delay on tariffs briefly triggered a significant short-covering rally, only for the White House to swiftly debunk the rumor.

While shorts have been squeezed out in this volatile bounce, the fundamental tensions remain unchanged. We believe new short positions at these levels carry considerable risk, potentially setting the stage for markets to find a bottom in the near term. We are expecting further liquidations of shorts and a potential recovery of markets from here. But we are not out of woods in terms of recovering all the way to previous highs. Geopolitics in the new bipolar world Crucially, the geopolitical landscape is undergoing a seismic shift, shaping what could define global relations for the next 50 years. We are entering a clearly bipolar era dominated by the U.S. and China. This marks the start of a multi-decade Cold War scenario, assuming military escalations, such as in Taiwan, remain contained—though the threat persists. Trump's aggressive timeline reflects his urgency to solidify his legacy and establish firm global alliances. Historically, China's rise has always been a bipartisan U.S. concern. Even under Biden, trade tensions gradually intensified. Trump's current actions merely accelerate this process. The question now is: Who will align with the U.S.? European nations and Canada face tough decisions, caught between economic dependency and costly demands for loyalty. Japan and Korea, heavily reliant on U.S. military and economic support, have little choice but to remain aligned with America. For India and Vietnam, aligning with the U.S. against regional rival China seems logical. Conversely, Brazil, Russia, and various Middle Eastern nations may increasingly lean toward China as a strategic counterbalance. This rapid reshuffling represents the most significant realignment of global powers since World War II, a true test of local leadership with profound implications for decades, perhaps centuries. 🔍 What We’re Watching • A potential short covering rally to define new levels forming in key sectors for bottom. • Safe-haven flows and bond yields changing direction • Leadership from top tech names and Nasdaq showing strength again 📢 Join the Discussion in Our Macro WhatsApp Group!

Proflex Subscribers – Staying Ahead of the Curve 📈 Separating Noise from Signal: In volatile markets, we help subscribers stay disciplined and focus on strategic long-term opportunities. Proflex All-Access: Your Market Compass

Explore the financial markets with Proflex All-Access, your comprehensive resource for deeper market understanding and active participation. This premium service offers subscribers exclusive insights and actionable investment advice, giving you a significant edge in various market conditions.

Proflex All-Access provides detailed analyses and recommendations to optimize your investment strategy. Our specialized newsletters include:

• Growth Gazette: Aimed at achieving above-market returns for aggressive portfolio growth.

• Income Insider: Focused on conservative strategies and income generation for yield-seeking investors.

• Crypto Pulse: Offers advanced strategies for investing in the rapidly expanding cryptocurrency market.

Best regards, Raman Bindlish Editor-in-Chief, Blockstart Research

ProFlex® by Blockstart Research

Legal Disclosures ProFlex® by Blockstart Research, the premium newsletter product series, provides informational and educational content only and does not offer personalized investment advice or establish a fiduciary relationship. While we rely on reliable sources and research, the information is not tailored to individual financial situations. Readers are urged to consult qualified financial professionals before making investment decisions. We do not guarantee the accuracy, completeness, or timeliness of the information and are not responsible for any investment decisions based on this newsletter. Investing carries risks, and past performance doesn't predict future results. By accessing this newsletter, you acknowledge that we are not liable for actions or decisions resulting from its content. Please conduct due diligence and seek professional advice as needed.

|

Blockstart Research Proflex Series

ProFlex® is designed to optimize your time, ignite your investment IQ, and maximize your financial potential.