Proflex Institutional Research Series

ProFlex® is designed to optimize your time, ignite your investment IQ, and maximize your financial potential.

Proflex Wk 08 — Tariff Chaos, Stable Macro, NVDA Earnings

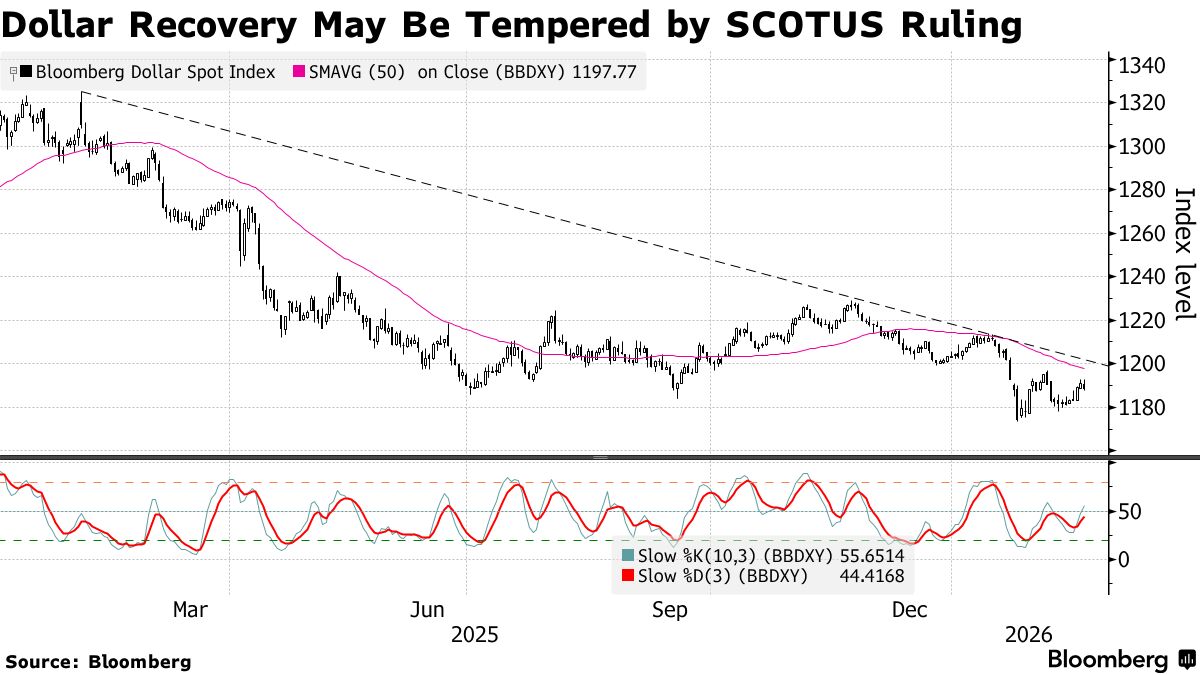

Proflex Market Update - Wk 08 Tariff Chaos | Macro Stability | Tech's Critical Bottom Last week, the return of tariff uncertainty has reopened a major macro risk as the Supreme Court invalidated key tariffs, only for the administration to respond with an immediate, escalated 15% global tariff hike. This has put global trade deals back in doubt, forced companies to reassess supply chains, and injected fresh uncertainty into markets already sensitive to policy shocks. At the same time, Tech is...

Proflex Wk 07 — Big Tech Stress in a over-leveraged retail market

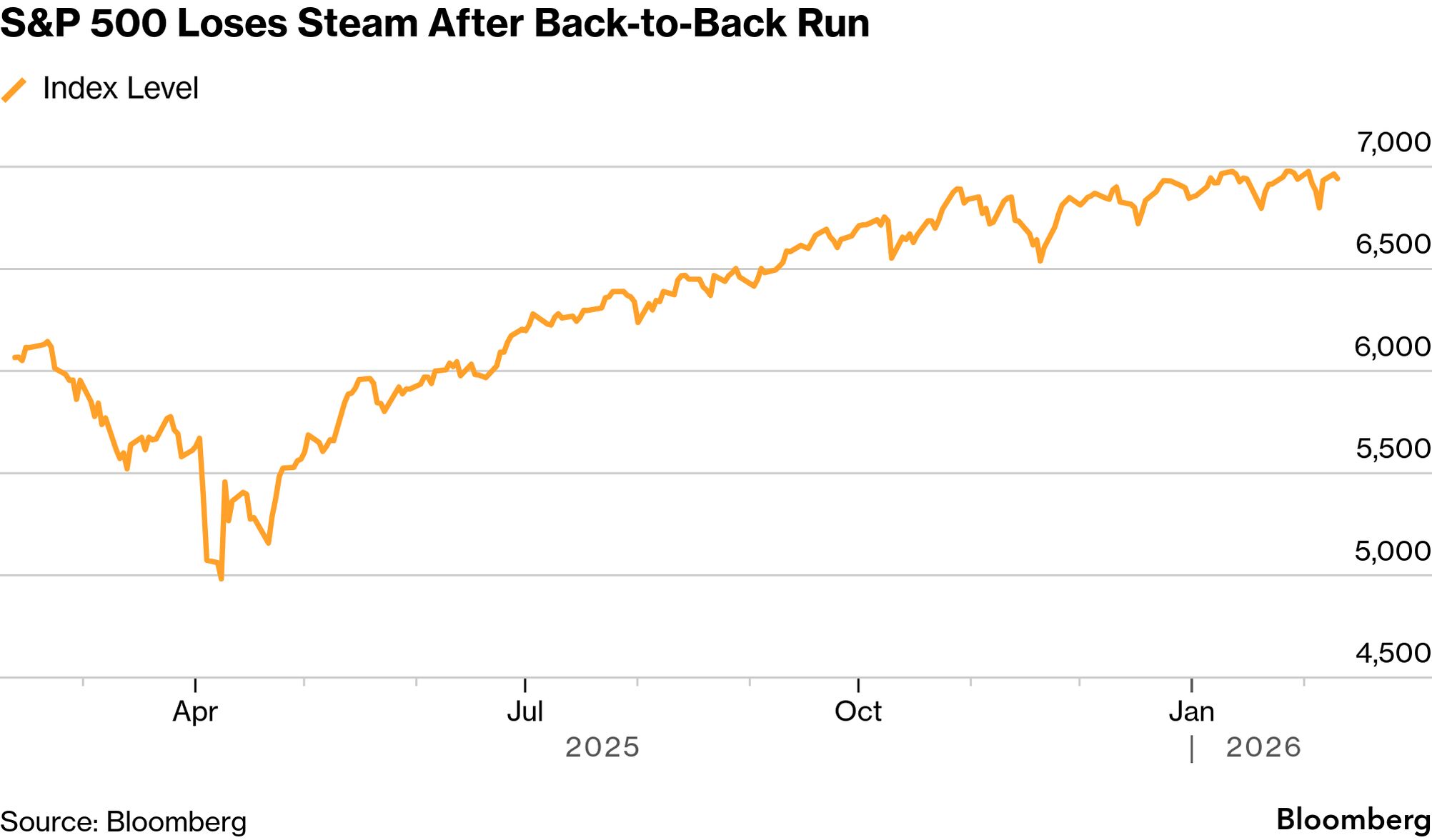

Proflex Market Update - Wk 07 S&P Stalls | Tech Re-rate & Volatility Surge | Warsh's Fed Play “The market isn't looking for new highs; it's looking for conviction. And right now, only the patient will find it.”— Proflex Panel February 2026 saw the S&P 500 hitting a perplexing wall, defying broader market strength as tech giants struggled. Software & tech sectors sank sharply (S&P 500 software index down ~13% in early Feb), erasing gains due to Anthropic Cowork launch and uncertainty around...

Proflex Wk 06 — Market Shakeout, AI Capex, Bitcoin Rebound

Proflex Market Update - Wk 06 Market Shakeout | AI CapEx Sustained | Bitcoin Rebound “The market is performing a high-wire act: seemingly flat, yet violently flushing leveraged & speculative weak hands"— Proflex Panel The S&P, after a strong start to 2026 gaining ~1.4% in January and briefly crossing 7,000 intraday, has settled into a pattern of extreme weekly volatility. Intraday volatility on the rise: US Indices Despite robust earnings growth "way higher than estimates," the index shows...

Proflex Wk 05 — Warsh Nomination, Metals Meltdown, AI Earnings

Proflex Market Update - Wk 05 Warsh Uncertainty | AI's Shifting Sands | Metals Meltdown "We've cautioned that the rapid surge in precious metals was built on froth and leveraged positions, not just fundamental demand. Last week's washout is precisely what we anticipated—a necessary cleansing."— Proflex Panel Last week rattled markets, climaxing in a shocking Friday.The potential nomination of Kevin Warsh to a key Fed role injected significant uncertainty into an already sensitive market ahead...

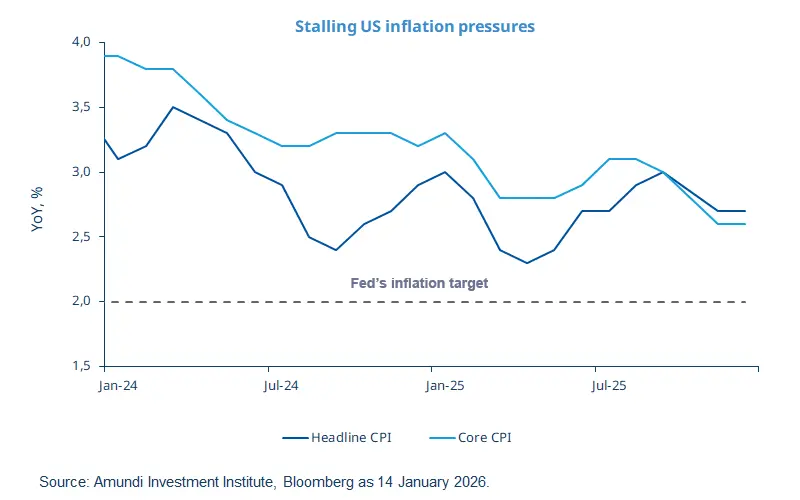

Proflex Wk 04 — Stubborn Inflation, Delayed Cuts, Gold & Bitcoin

Proflex Market Update - Wk 04Stubborn Inflation | Fed's Tightrope | Gold vs BitcoinJanuary 2026 draws to a close with the Federal Reserve maintaining its holding pattern on interest rates, defying some market hopes for an early pivot. This steadfast stance comes as inflation, while showing signs of cooling, remains stubbornly above target. Market Inflation down but remains above Fed Target: Bloomberg Meanwhile, the race for 2026's top-performing asset has already begun in earnest, with gold...

Proflex Wk 03 — K Shaped Market, Pseudo QE, Bitcoin Inflection

Proflex Market Update - Wk 03K-Shaped Market | Pseudo QE | Bitcoin's Institutional Resurgence “The market isn't easy anymore. It's a K-shaped reality where only precise analytics and selective conviction cut through the noise.”— Proflex Panel As Q4 earnings season kicks into gear, 2026 has started with a nuanced tone. While the S&P 500 has flirted with new highs, largely moving sideways in a tight 20-point range, a significant sector rotation is underway. K-Shaped Recovery: Equity divergence...

Proflex Wk 02 — A Selective Market in a New Liquidity Regime

Proflex Market Update - Wk 02 "Entering the 2026 market is like moving from a wide, calm motorway to a narrow mountain pass. Every lane counts, and the dashboard dictates survival.”— Proflex Panel Coming off three consecutive years of double-digit S&P 500 returns, 2026 demands a starkly different approach. We project a landscape characterized by higher risks for the same rewards, defined by Trump’s election year policy giveaways and escalating geopolitical friction. Market Resilience after a...

Proflex Wk 01 — Oil Volatility, Quiet QE, AI Leads

Proflex Market Update - Wk 01 “Consensus sees crisis; we see opportunity in the capital flows that ignore it.” — Proflex Panel The year kicks off with a potent cocktail of geopolitical tension and shifting liquidity dynamics. The audacious capture of Nicolás Maduro has instantly reshaped the US-Venezuela narrative, injecting fresh uncertainty into global oil markets. Yet, beneath the headlines, the Fed is quietly expanding its balance sheet, while the AI trade, fueled by semiconductor giants,...

Proflex Wk 51 — Calm Macro, OpenAI Deal, Gold Highs

Proflex Market Update - Wk 51 Market Resilience | OpenAI $100Bn Deal | CPI Relief “Every dip in this market has been bought with conviction, suggesting a deeper liquidity pool than the skeptics admit. Consensus is wrong to simply focus on headline numbers; the resilience is the story.”— Proflex Research Last week saw a significant shift: markets broadly advanced with a notable dip in volatility. SPX & VIX: Clear Divergence The underlying narrative points to a calming macro landscape, fueled...

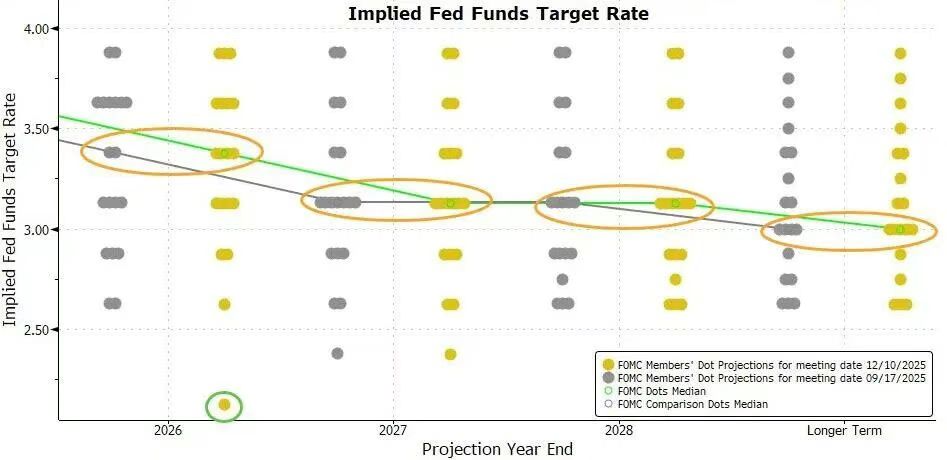

Proflex Wk 50 — Hawkish Cut + QE, Oracle, Bitcoin Reset

Proflex Market Update - Wk 50 Hawkish Cut & QE | Oracle Earnings | Bitcoin Reset Last week, markets rallied following the Federal Reserve's December 10 rate cut, pushing SPX to near all-time highs. The Federal Reserve delivered its third consecutive 25 basis point rate cut, bringing the federal funds rate to 3.50%-3.75%. More critically, the Fed signaled it expects only one rate cut in 2026 versus three executed in 2025, suggesting the cutting cycle may be over. Fed Dotplot: One Rate Cut...

ProFlex® is designed to optimize your time, ignite your investment IQ, and maximize your financial potential.