ProFlex® is designed to optimize your time, ignite your investment IQ, and maximize your financial potential.

Proflex Market Update - Wk 10

|

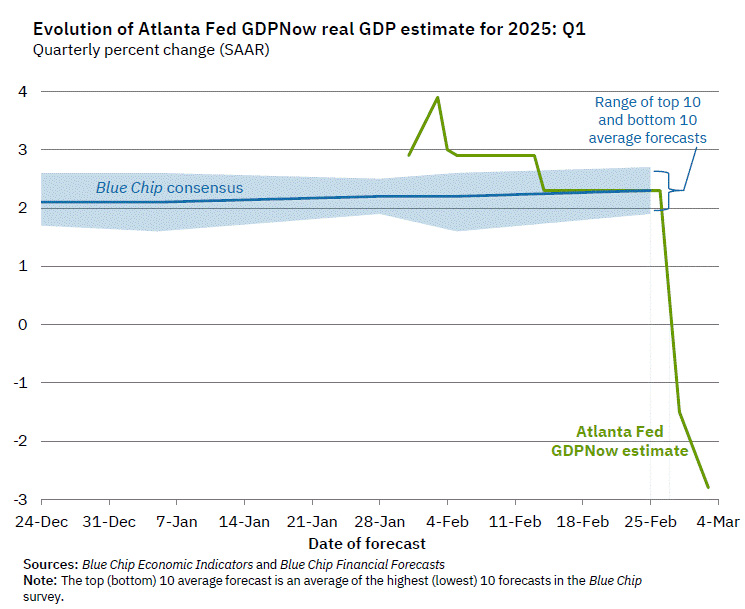

Proflex Market Update - Wk 10 Welcome to another weekly update from Proflex! Markets remain highly volatile, with momentum turning negative over the past week. Investor sentiment is shifting as multiple risk factors have emerged, and the overbought conditions that we discussed in our community call last week have started to impact equities. GDP Growth Estimates Revised Sharply Lower • The Atlanta Fed GDP estimate was revised downwards by a significant margin, highlighting the steep slowdown in economic activity. • This is in contrast to the recent market euphoria, suggesting a disconnect between economic fundamentals and investor sentiment in recent times.

Euphoria & Retail Investment Surge Created Overbought Conditions • Record retail investment has flooded into stocks over the past few weeks. • Sentiment indicators had hit extreme greed levels, setting up the market for a correction. • We talked about this in last week’s community call, and we are seeing profit-taking and rotation play out in markets. 📌 What This Means:

Markets appear stretched and technical correction is ongoing, and we maybe entering a phase of heightened volatility. Tariffs and economic slowdown signals are the biggest risks ahead, and we will be closely tracking how markets digest new data.

NVDA Earnings – A Strong Report but a Weak Stock Reaction NVDA reported strong earnings, beating expectations and raising forward guidance to $43B, confirming that AI demand remains robust. However, NVDA’s stock tumbled post-earnings due to: • Extreme options market leverage, which led to sharp unwinding. • Market struggling to find new leadership, causing large swings in mega-cap tech stocks. • Pattern repetition: We have seen NVDA dip after earnings almost every quarter before recovering strongly. The AI Trade Remains Intact: • NVDA’s earnings confirm that AI spending remains on a strong trajectory. • AVGO (Broadcom) reports earnings this week, and its commentary on AI demand will be another critical data point for investors. 📌 Key Takeaway:

Earnings season has proven that AI spending is NOT slowing down, but market structure issues are causing short-term mispricings in AI stocks.

Proflex All-Access subscribers continue to receive regular updates on how to benefit from this environment of high volatility.

Crypto Market: A Massive Meltdown & Trump’s Tweet Crypto markets collapsed last week, breaking key technical levels and triggering forced liquidations. Bitcoin took support on its 200DMA, but sentiment remained fragile. Donald Trump tweeted over the weekend about adding Bitcoin to the U.S. strategic reserves, causing a bounce above $90k.

Our View: While this boosted sentiment, Congress is unlikely to approve any government Crypto purchases beyond Bitcoin which has digital gold narrative as well as bipartisan support. Also, there are significant hurdles in getting this bill approved in congress even for Bitcoin reserve as we have seen with various state legislative efforts. However, Trump’s endorsement of Bitcoin continues to strengthen the narrative of Bitcoin as a strategic reserve asset for nation-states and corporate treasuries. This is long-term bullish for Bitcoin but should not be overestimated in the short term. 📌 What This Means:

Bitcoin remains a long-term buy, it is getting closer to live up to its digital gold narrative, but traders should remain cautious with high leverage.

📢 Join the Discussion in Our Macro WhatsApp Group!

Proflex Subscribers – Staying Ahead of the Curve 📈 Separating Noise from Signal: In volatile markets, we help subscribers stay disciplined and focus on strategic long-term opportunities. Proflex All-Access: Your Market Compass

Explore the financial markets with Proflex All-Access, your comprehensive resource for deeper market understanding and active participation. This premium service offers subscribers exclusive insights and actionable investment advice, giving you a significant edge in various market conditions.

Proflex All-Access provides detailed analyses and recommendations to optimize your investment strategy. Our specialized newsletters include:

• Growth Gazette: Aimed at achieving above-market returns for aggressive portfolio growth.

• Income Insider: Focused on conservative strategies and income generation for yield-seeking investors.

• Crypto Pulse: Offers advanced strategies for investing in the rapidly expanding cryptocurrency market.

Best regards, Raman Bindlish Editor-in-Chief, Blockstart Research

ProFlex® by Blockstart Research

Legal Disclosures ProFlex® by Blockstart Research, the premium newsletter product series, provides informational and educational content only and does not offer personalized investment advice or establish a fiduciary relationship. While we rely on reliable sources and research, the information is not tailored to individual financial situations. Readers are urged to consult qualified financial professionals before making investment decisions. We do not guarantee the accuracy, completeness, or timeliness of the information and are not responsible for any investment decisions based on this newsletter. Investing carries risks, and past performance doesn't predict future results. By accessing this newsletter, you acknowledge that we are not liable for actions or decisions resulting from its content. Please conduct due diligence and seek professional advice as needed.

|

Blockstart Research Proflex Series

ProFlex® is designed to optimize your time, ignite your investment IQ, and maximize your financial potential.