ProFlex® is designed to optimize your time, ignite your investment IQ, and maximize your financial potential.

Proflex Wk 01 — Oil Volatility, Quiet QE, AI Leads

|

Proflex Market Update - Wk 01

“Consensus sees crisis; we see opportunity in the capital flows that ignore it.” — Proflex Panel The year kicks off with a potent cocktail of geopolitical tension and shifting liquidity dynamics.

Key Drivers This Week

|

President Trump's subsequent calls for new U.S. energy investment in Venezuela, despite billions owed to American companies, underscore the high stakes.

The diplomatic relationship, strained for decades, is at a critical juncture.

Sanctions by the U.S., E.U., Canada, and others have crippled Venezuela's economy. Now, the potential for a new era could unlock significant oil flows, fundamentally altering global energy dynamics.

The Fed's Stealth Expansion: More Than Meets the Eye

While much of the Street remains fixated on interest rate rhetoric, our analysis confirms the Fed has subtly undone a significant portion of its Quantitative Tightening (QT), with its balance sheet quietly expanding in recent weeks.

This stealth injection of liquidity, often overlooked in mainstream commentary, is a powerful underlying force.

This proactive balance sheet adjustment is a critical inflection point, signaling a more accommodative stance than publicly acknowledged.

This marks a clear shift toward accommodation, creating a strong tailwind for risk assets and undermining the purely hawkish Fed narrative over the coming quarters.

AI's Reignition: Semiconductors Lead the Charge

The AI trade is not just back; it’s being aggressively pushed by major investment banks like Goldman Sachs, signaling renewed institutional conviction.

Semiconductor stocks are leading this charge, demonstrating robust performance even as geopolitical tensions mount.

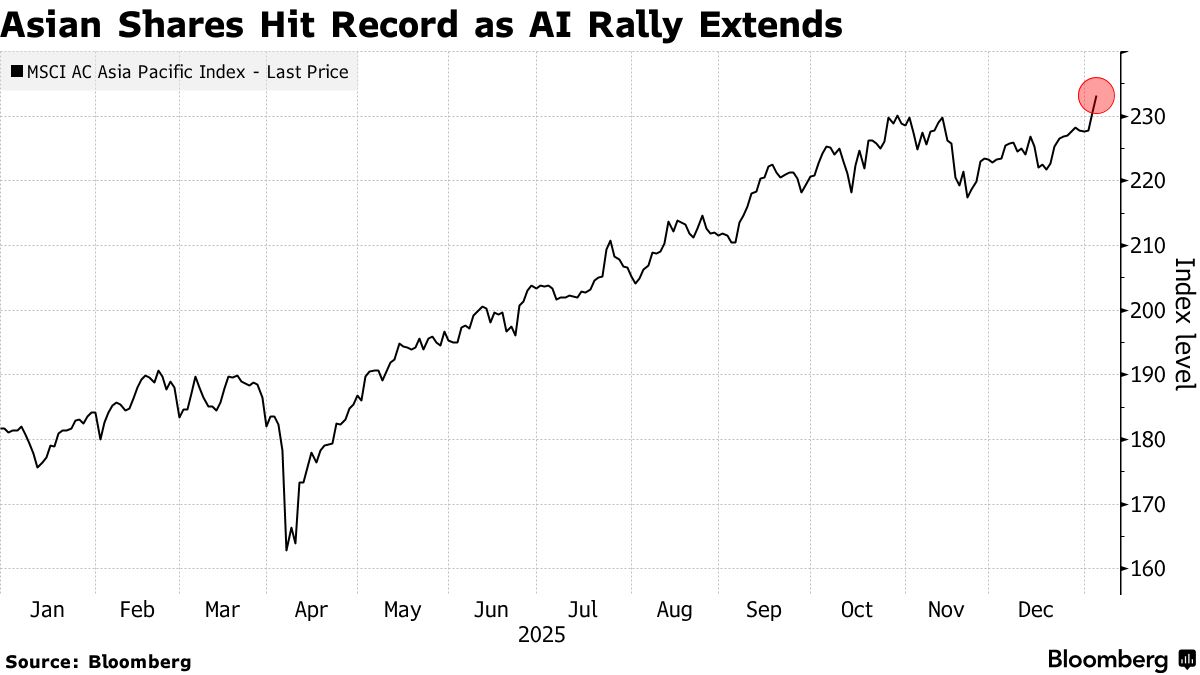

The S&P 500 and Asian markets hitting record highs today, driven specifically by tech and AI, shows a clear flight to quality within equities.

|

This isn't merely a speculative bounce; it's a strategic rotation of capital into long-term growth narratives.

Companies at the forefront of AI innovation and chip manufacturing are seeing significant investment inflows.

Digital Assets & Precious Metals: The Great Rotation

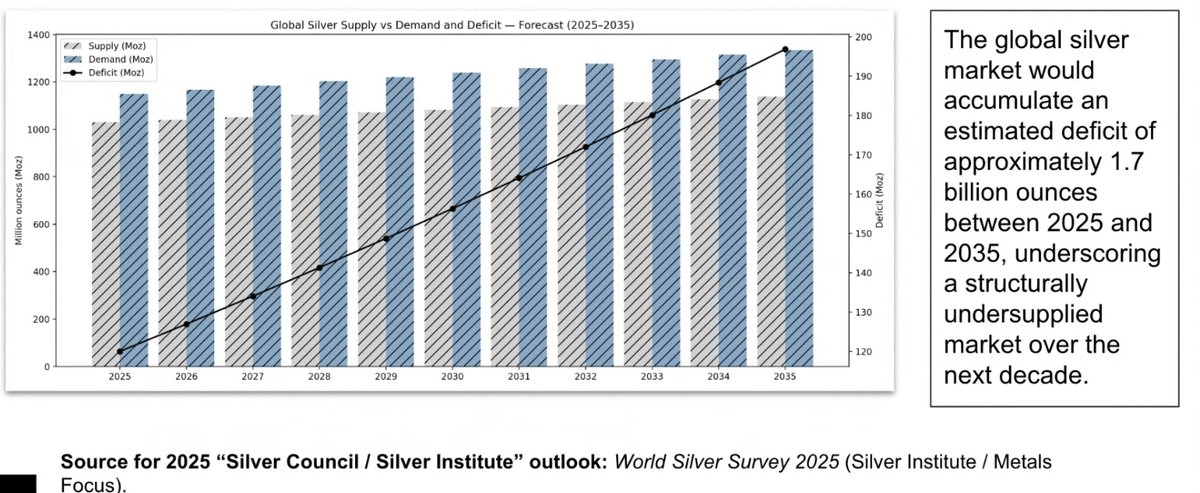

Precious metals, after a monumental rally, are showing signs of increased volatility, with a significant amount of shorts getting liquidated.

The trade in gold and silver is becoming tricky in 2026 after its huge rally. This pause in momentum could catalyze a rotation of capital into other high-beta assets.

|

Enter Bitcoin.

After appearing to bottom towards the end of 2025, Bitcoin is now attempting to catch fresh momentum. With traditional safe-havens like gold and silver taking a breather, smart money is eyeing Bitcoin as the next high-conviction play.

🧭 Proflex Playbook – Navigating Liquidity & Volatility

The market is always forward-looking. Those who adapt to the new flow of capital will capture the next cycle.

The market's resilience despite geopolitical shocks, coupled with stealth liquidity injections, demands a refined strategy.

This isn't the time for complacency, but for calculated conviction.

Our conviction stays anchored in the data:

- Focus on Structural Growth: Continue to overweight the secular AI theme, recognizing its multi-year runway.

- Anticipate Shallow Corrections: Use dips as accumulation opportunities, not reasons for fear, understanding that "none of the corrections stick."

- Diversify Thoughtfully: Recognize the "decorrelation" across asset classes; consider gold, silver and Bitcoin for portfolio resilience.

- Develop Mental Models: Prioritize long-term planning (6-12 months out) over short-term news, aiming for consistent, incremental gains.

If you're an All-Access or Managed Portfolio subscriber, our positioning has already shifted ahead of this moment—scaling up asymmetric hard asset plays while hedging for earnings volatility and geopolitical tail risks.

| Proflex All-Access Subscription (Yearly) |

| Proflex All-Access Subscription (Monthly) |

Until next week,

— The Proflex Team

Trusted Macro Insights. Calm Investing. Tactical Trades.

Legal Disclosures

Proflex Institutional Research Series

ProFlex® is designed to optimize your time, ignite your investment IQ, and maximize your financial potential.