ProFlex® is designed to optimize your time, ignite your investment IQ, and maximize your financial potential.

Proflex Wk 04 — Stubborn Inflation, Delayed Cuts, Gold & Bitcoin

|

Proflex Market Update - Wk 04

Insights from Proflex Macro Call

|

|

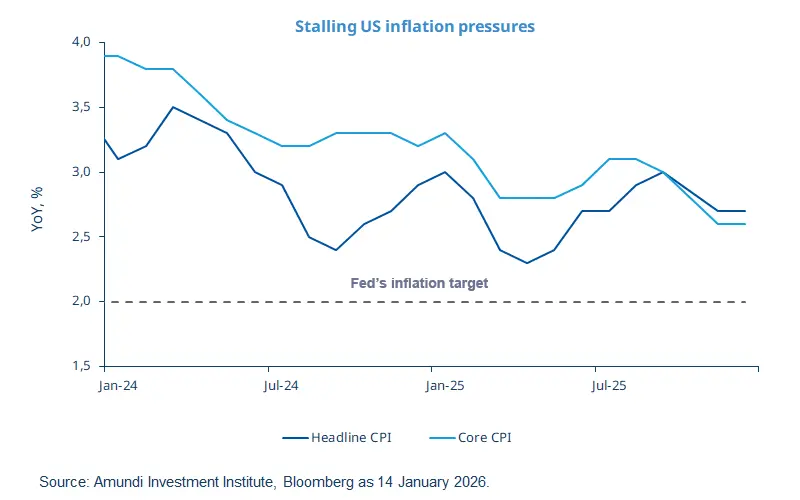

Consensus anticipates a gradual descent, with the median FOMC projection at 2.4% by end-2026, but forecasts to core inflation remain firmly above 2% through much of 2026.

This suggests any rate cuts will be defensive, not stimulative, fundamentally altering the risk landscape for equities and favoring real assets.

— Proflex Macro Discussion

This time is different because the inflation narrative is not just about supply shocks, but structural shifts.

Unless inflation rapidly capitulates to the 2% target, the current Fed stance provides a strong tailwind for assets that thrive in persistent inflationary environments.

You can watch the recording of the full weekly discussion here:

Key Drivers This Week

Equity Market Crossroads: S&P 500's Volatile Start

The S&P 500 began this week with considerable volatility, with futures dropping 0.8% and the Nasdaq-100 falling >1% following Intel's 17% plunge (Morningstar).

|

Despite a forecast for the S&P 500 to close 2026 with a stellar performance, recent price action suggests significant "bull traps" are in play.

The market's initial optimism for 2026 has been met with sharp corrections, particularly in tech.

The question is whether these are temporary pullbacks in a longer bull run or early warnings of deeper structural issues, especially if inflation remains sticky and the Fed remains firm.

While long-term forecasts remain bullish, the immediate future demands tactical precision and an understanding of the underlying macro currents.

Fed's Unwavering Stance: Rates to Hold in Q1 2026

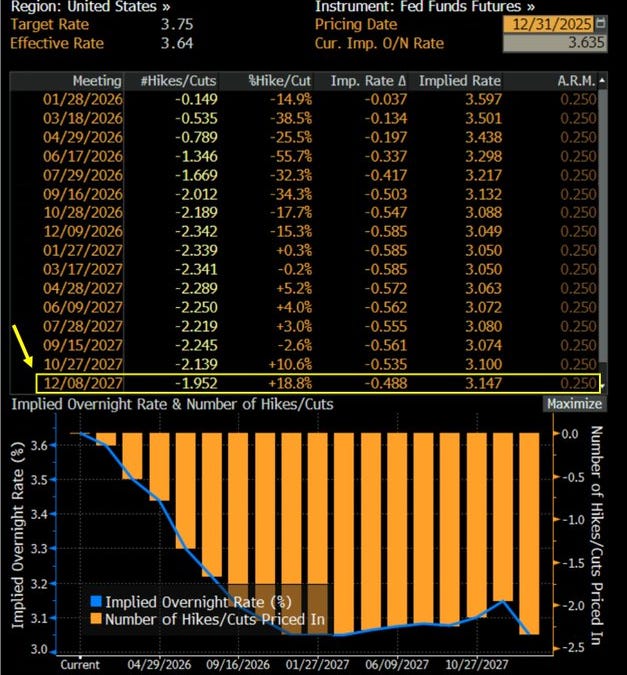

The US Fed is widely expected to keep interest rates unchanged at its first meeting of 2026, a decision reinforced by persistently high inflation and robust economic growth.

Markets are pricing roughly 8 cuts (~200 bps) over the long term, with the bulk of easing pushed out into late 2026–2027 rather than the near term.

|

This reinforces a “higher for longer first, cuts later” regime—where rate cuts are expected to be defensive, not a return to easy-money policy.

Fed Governor Bowman, speaking on January 16, 2026, noted continued economic growth and inflation moving closer to the goal, but pointed to nuances in the labor market.

Despite declining job gains, the overall economic picture remains too strong to warrant a dovish pivot.

The New York Fed's Survey of Consumer Expectations, also shows inflation expectations remain well anchored, paradoxically giving the Fed less urgency to cut rates.

The 2026 Hard-Asset Race: Gold Surges, Bitcoin Stumbles

The competition for 2026's top asset is heating up, with Gold positioning as a strong contender.

Polymarket traders give gold a 47% chance of being the best performing asset in 2026, compared to 39% for the S&P 500.

This prediction is playing out, with gold futures topping $5,000 and breaking above $4,900 in January 2026.

Conversely, Bitcoin struggled to breach the $100,000 mark and is trading around 10% below its January 2026 peak.

The Bitcoin 2026 outlook now hinges regulatory clarity and macroeconomic conditions. While Bitcoin's volatility remains a hurdle, its correlation with gold is tightening.

Historically, Bitcoin bull phases have followed gold’s breakouts with a lag, as liquidity first moves into hard assets before rotating into higher-beta alternatives.

|

If this pattern holds, gold’s recent surge could set the stage for a renewed catch-up phase in Bitcoin as institutional flows rebuild.

Moreover, a crypto-friendly Federal Reserve chair, potentially appointed in 2026, could further catalyze adoption by legitimizing Bitcoin as a hedge against currency depreciation.

🧭 Proflex Playbook – Positioning for Persistence, Not Perfection

The market wants a return to normalcy, but inflation and central bank resolve are shaping a different reality.

The Fed's resolute stance and the divergence in asset performance demand a sharpened strategy for 2026.

Our conviction stays anchored in the data:

- Focus on Structural Growth: Continue to overweight the secular AI theme, recognizing its multi-year runway.

- Anticipate Shallow Corrections: Use dips as accumulation opportunities, not reasons for fear, understanding that "none of the corrections stick."

- Diversify Thoughtfully: Recognize the "decorrelation" across asset classes; consider gold, silver and Bitcoin for portfolio resilience.

- Develop Mental Models: Prioritize long-term planning (6-12 months out) over short-term news, aiming for consistent, incremental gains.

If you're an All-Access or Managed Portfolio subscriber, our positioning has already shifted ahead of this moment—scaling up asymmetric hard asset plays while hedging for earnings volatility and geopolitical tail risks.

| Proflex All-Access Subscription (Yearly) |

| Proflex All-Access Subscription (Monthly) |

Until next week,

— The Proflex Team

Trusted Macro Insights. Calm Investing. Tactical Trades.

Legal Disclosures

Blockstart Research Proflex Series

ProFlex® is designed to optimize your time, ignite your investment IQ, and maximize your financial potential.