ProFlex® is designed to optimize your time, ignite your investment IQ, and maximize your financial potential.

Proflex Wk 30 - Yen Shifts, Cuts Delay, Crypto Marches

|

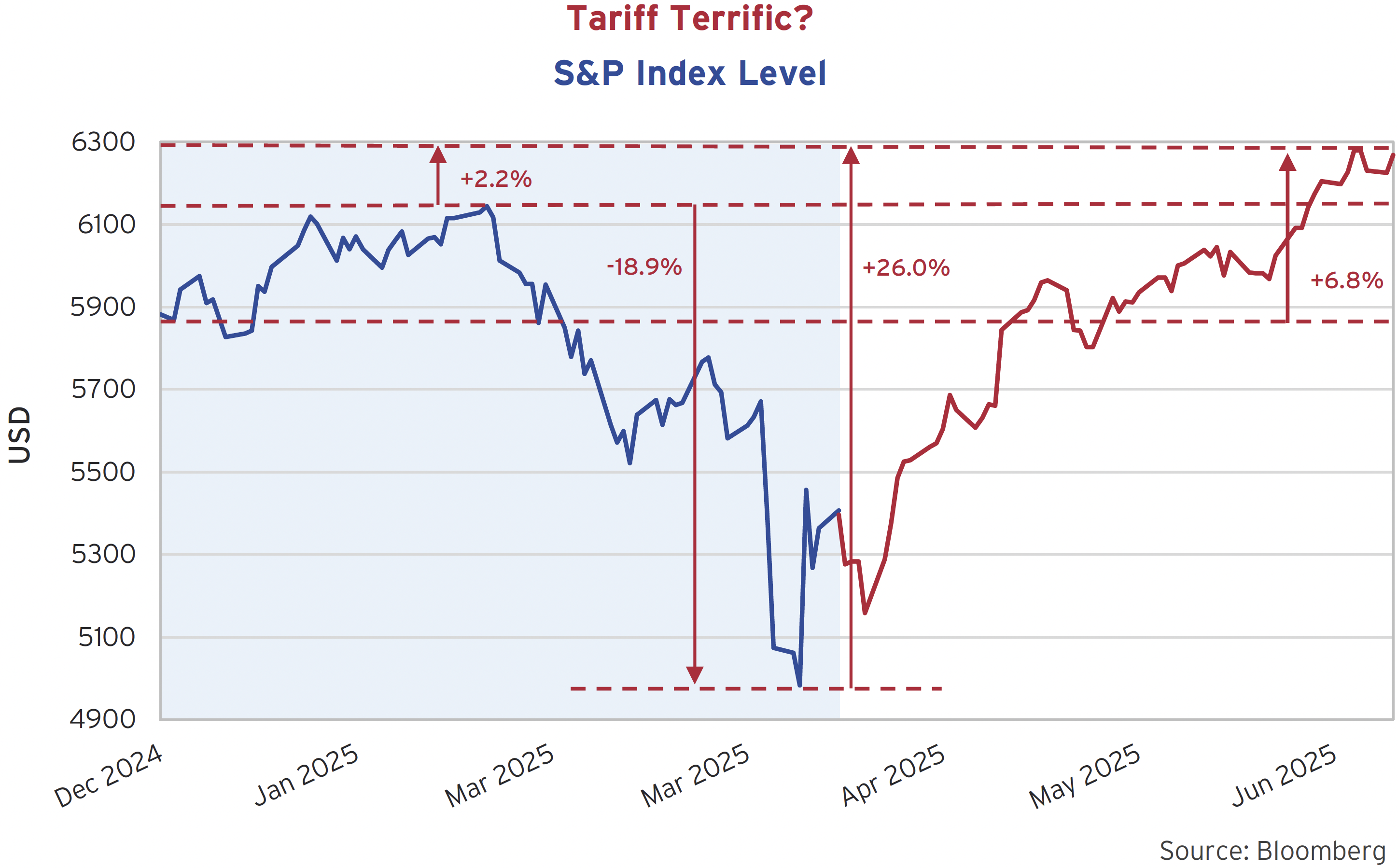

Proflex Market Update - Wk 30 “Liquidity is here. Direction isn't. The next two weeks will decide which narrative takes control.” Markets made new all-time highs last week, with the S&P 500 briefly pushing above 6,320. But the tone remains undecided—chop, not conviction. With earnings season heating up and multiple macro catalysts on deck, the next two weeks will likely dictate the rest-of-year trajectory.

While monetary signals remain supportive—rising M2, softening global policy, and still-positive ETF flows into hard assets—equity valuations now rest on fragile foundations. The rally now hinges on two parallel pivots:

Meanwhile, geopolitical overhangs remain. Trump’s aggressive August 1 tariff deadline is fast approaching. And over the weekend, Japan’s ruling coalition lost majority control, leading to volatility in JGB yields and Yen carry trades—adding a new global tail risk to already jittery FX markets. Insights from the Proflex Macro Call“All-Time Highs Are the Beginning, Not the End.” “Fear of heights in markets is irrational—liquidity, not gravity, drives the next leg.” — Proflex Macro Discussion This time is no different. With global M2 rising and cross-asset highs in stocks, gold, and Bitcoin, the macro setup suggests it’s liquidity—not valuations—fueling the rally. Key Drivers This Week💻 Tech Earnings Hold the Key to S&P’s Premium The AI narrative has carried the S&P to stretched valuations (~22x forward), but now the real test begins: This week:

The top 10 tech names now account for ~35% of the S&P’s market cap. That means a single earnings miss can derail the index—even if fundamentals elsewhere stay intact.

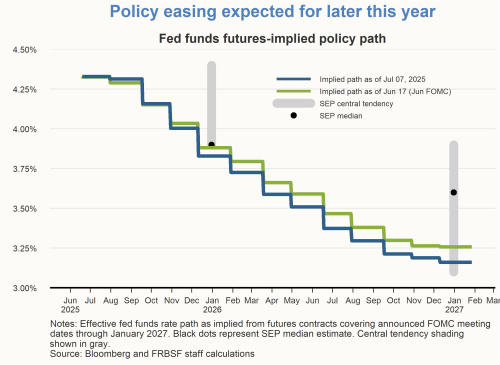

“This is a belief test. AI can’t just deliver growth. It must deliver upside above expectations.” 🧭 Fed Meeting – The Global Policy Chessboard Tightens The upcoming FOMC meeting (July 29–30) is arguably more important than any single data point. Why? The Fed is now an outlier.

Yet U.S. futures are still pricing no cut in July, despite growing pressure from the Trump camp to ease and rising political incentives ahead of the election cycle.

Fed Fund Futures:

“Global central banks are in easing mode—but the Fed still holds the narrative pen.” Fed commentary, not policy, will shape expectations for the back half of the year. 💥 Geopolitics: Tariffs and the Yen Risk Flash Two undercurrents could rapidly ripple into markets: 1. Tariff Deadline (Aug 1)

2. Japan's Coalition Loss

💰 Bitcoin — Institutional Flows Keep Driving Conviction Bitcoin continues its steady grind higher, closing the week at $120K. This isn’t froth—it’s structured capital.

“This is no longer a speculation story—it’s a capital rotation.” As long as M2 expands and real yields compress, Bitcoin will remain the high-conviction play. 👉 Want to learn how to invest in BTC with hedged upside exposure and controlled risk?

🧭 Proflex Playbook – Liquidity is Here, Earnings Are Next We are at a critical inflection point. The market isn’t breaking down—but it’s looking for a story strong enough to carry it higher. So what’s our move? Our stance stays anchored in the data: ✅ Stay Long Hard Assets — Bitcoin, gold, and silver have front-run policy “The next move won’t be slow. Stay positioned—but not overcommitted.” If you're an All-Access or Managed Portfolio subscriber, our positioning has already shifted ahead of this moment—scaling up asymmetric hard asset plays while hedging for earnings volatility and geopolitical tail risks. 📣 Join the Macro WhatsApp Group for weekly calls, market insight, and real-time macro signals.

Proflex All-Access: Your Market Compass

Explore the financial markets with Proflex All-Access, your comprehensive resource for deeper market understanding and active participation. This premium service offers subscribers exclusive insights and actionable investment advice, giving you a significant edge in various market conditions.

Proflex All-Access provides detailed analyses and recommendations to optimize your investment strategy. Our specialized newsletters include:

• Growth Gazette: Aimed at achieving above-market returns for aggressive portfolio growth.

• Income Insider: Focused on conservative strategies and income generation for yield-seeking investors.

• Crypto Pulse: Offers advanced strategies for investing in the rapidly expanding cryptocurrency market.

Until next week,

ProFlex® by Blockstart Research

Legal Disclosures ProFlex® by Blockstart Research, the premium newsletter product series, provides informational and educational content only and does not offer personalized investment advice or establish a fiduciary relationship. While we rely on reliable sources and research, the information is not tailored to individual financial situations. Readers are urged to consult qualified financial professionals before making investment decisions. We do not guarantee the accuracy, completeness, or timeliness of the information and are not responsible for any investment decisions based on this newsletter. Investing carries risks, and past performance doesn't predict future results. By accessing this newsletter, you acknowledge that we are not liable for actions or decisions resulting from its content. Please conduct due diligence and seek professional advice as needed.

|

Blockstart Research Proflex Series

ProFlex® is designed to optimize your time, ignite your investment IQ, and maximize your financial potential.