ProFlex® is designed to optimize your time, ignite your investment IQ, and maximize your financial potential.

Proflex Wk 32 – Rally Cools, Rate Cuts Warm, AI Still Leads the Cycle

|

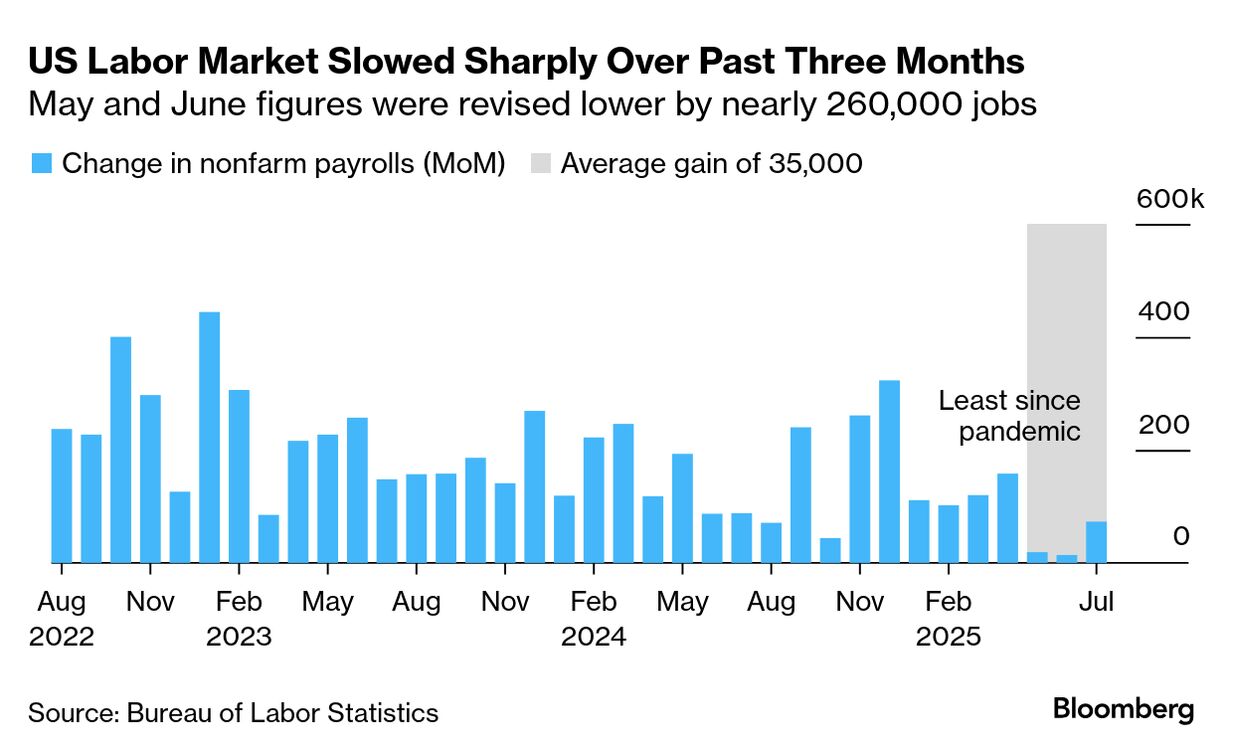

Proflex Market Update - Wk 32 “The swift correction was a gift, not a warning. The September pivot is now undeniable.” Markets saw record highs last week upwards of 6427, then a sharp correction post-jobs report.

The 'bad' jobs report was the best news bulls could have asked for; it unlocks the Fed's easing trigger.” — Proflex Macro Panel

Insights from the Proflex Macro Call"This Isn’t a Breakdown. It’s a Burnoff." One of the sharpest takeaways from this week’s Proflex macro discussion: the current market downturn isn’t the start of a bear market—it’s a normal, technical reset after an overheated rally. “Ignore labels like ‘10% correction’—they’re arbitrary. What we’re seeing is the market cutting out leverage, not collapsing.” — Proflex Macro Discussion Despite political noise on U.S. debt, capital is flowing into Treasuries, especially the 7-year auction, and the U.S. dollar remains a safe haven. Even inflation, often viewed as a threat, is being driven by tailwinds like tariffs—but the estimated CPI impact is just ~1% and likely short-lived. You can watch the recording of the full weekly discussion here:

Key Drivers This Week

|

Yields have already dropped heavily in anticipation, reflecting the market's clear expectation of a more accommodative stance.

This pivot, previously advocated by Trump's rate cut calls, places the Fed in a reactive position, solidifying the path for lower borrowing costs.

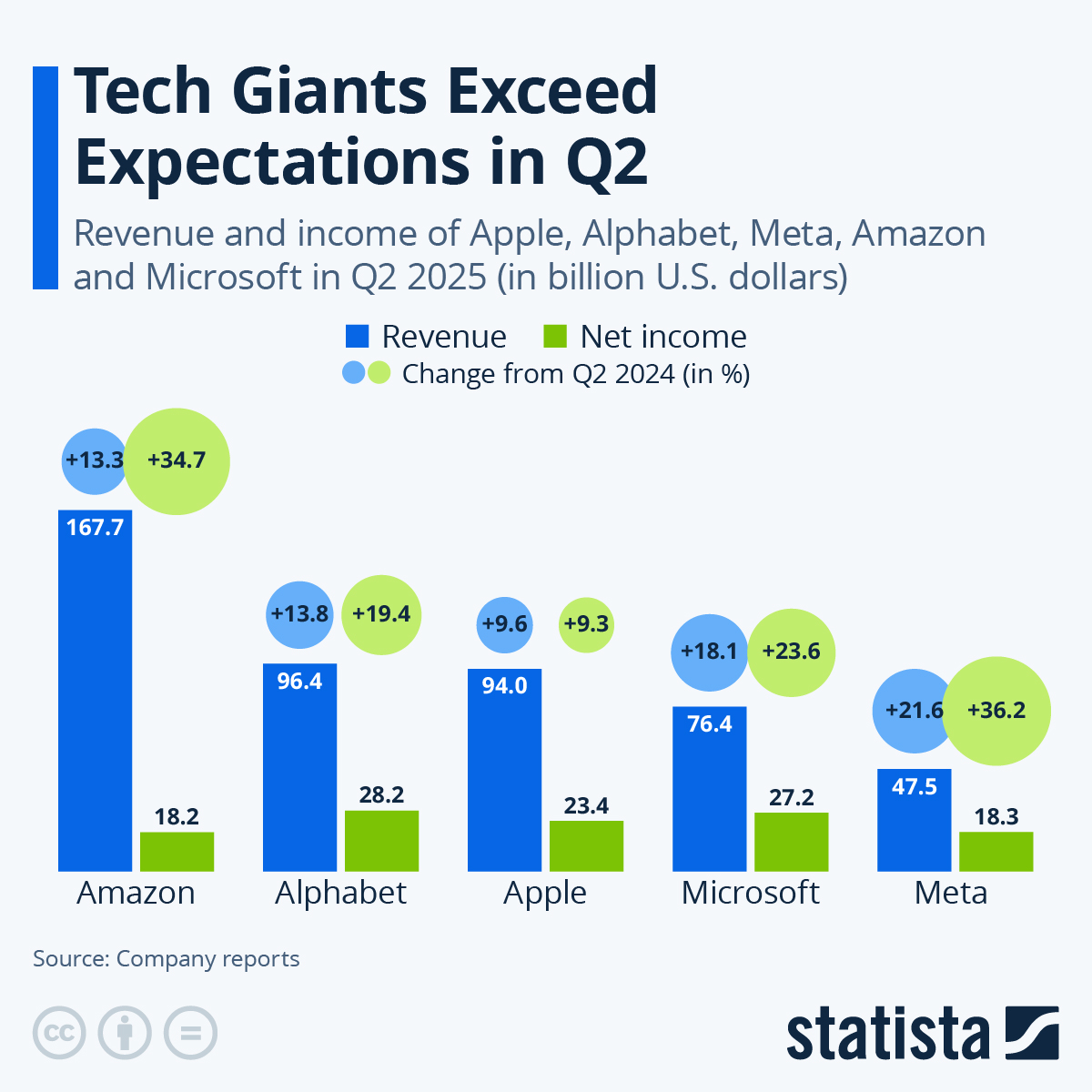

Market Volatility & AI's Unfinished Story

The market's sharp reversal after hitting new highs, triggered by Friday's jobs report and coupled with options expiry, created a critical profit-booking opportunity.

|

The core thesis stands: the AI trade is still in its early innings, representing a long-term trend that could play out over the next decade. Expect some consolidation in the near term, but macro indicators continue to favor a longer bull run.

Tariff Uncertainty & Geopolitical Overhangs

While recent trade uncertainties have seen some resolution, the overarching specter of tariff uncertainty remains a persistent undercurrent.

This lingering factor will continue to keep the market on its toes, influencing day-to-day moves and sentiment.

Expect geopolitical headlines to introduce short-term choppiness, serving as a reminder that macro risks, though sometimes overshadowed by earnings, are ever-present. This demands a nimble approach to tactical trading.

👉 Looking for ways to hedge against geopolitical volatility while still capturing upside?

|

Proflex All-Access Gain monthly access to our full research suite—and join a thriving investor community alongside 100+ Big Tech Executives and fund managers from Silicon Valley and beyond.

|

🧭 Proflex Playbook – Liquidity is Here, Earnings Are Next

We are at a critical inflection point. The market isn't breaking down; it's shedding froth, preparing for the next leg up catalyzed by impending Fed easing.

The message is simple: we ran up too fast, and a healthy rebalance is in play before the next surge.

Our stance remains rooted in positioning for the long-term structural shifts while staying tactical amidst near-term volatility.

Our stance stays anchored in the data:

✅ Stay Long Hard Assets — Bitcoin, gold, and silver have front-run policy

✅ Trade Equities Tactically — Let earnings decide who earns the premium

✅ Hedge for Volatility — Tariffs + Fed + FX = high optionality zone

✅ Monitor Fed Tone Closely — Be prepared for bond market volatility driven by Powell's guidance, not policy action.

If you're an All-Access or Managed Portfolio subscriber, our positioning has already shifted ahead of this moment—scaling up asymmetric hard asset plays while hedging for earnings volatility and geopolitical tail risks.

| Proflex All-Access Subscription (Yearly) |

| Proflex All-Access Subscription (Monthly) |

Until next week,

— The Proflex Team

Trusted Macro Insights. Calm Investing. Tactical Trades.

Legal Disclosures

Blockstart Research Proflex Series

ProFlex® is designed to optimize your time, ignite your investment IQ, and maximize your financial potential.