ProFlex® is designed to optimize your time, ignite your investment IQ, and maximize your financial potential.

Proflex Wk 34 – Jackson Hole Test, SLR Strength, Bitcoin Reserve Bid

|

Proflex Market Update - Wk 34 “Jackson Hole will test whether markets can hold their optimism as policy, liquidity, and geopolitics collide.” Markets continue their relentless march to new all-time highs, largely propelled by a surging tech sector with S&P reaching 6,480.

Beneath the policy cycle, deeper macro undercurrents are suggesting that:

Geopolitics adds another layer. Markets currently assign almost no probability to progress in the Russia–Ukraine conflict.

This week is ultimately a test of narratives: can Powell sustain market confidence in easing, or does the mix of sticky inflation, structural shifts, and geopolitical wildcards force a recalibration?

Insights for Proflex Weekly Macro Call

|

|

- Bitcoin Demand: DATs are a primary driver of new highs, institutionalising BTC as “digital gold.”

- Altcoin Expansion: Models now extend to Ethereum, Solana, and AI-linked tokens, with some treasuries accumulating faster than early Bitcoin adopters.

- Yield & Hedging: DAT structures enable options strategies — allowing investors to milk volatility of 100–500% without relying solely on price direction.

- Capital Inflows: VCs like A16Z are backing even small-cap tokens, accelerating adoption and market depth.

— Proflex Macro Discussion

You can watch recording of the full weekly discussion here:

Want to learn how to invest in BTC with hedged upside exposure and controlled risk?

|

Proflex All-Access Gain monthly access to our full research suite—and join a thriving investor community alongside 100+ Big Tech Executives and fund managers from Silicon Valley and beyond.

|

Key Drivers This Week

Jackson Hole: Fed Signals & Geopolitical Wildcards

The financial world descends on Wyoming for the Jackson Hole Economic Policy Symposium (August 22-24, 2025).

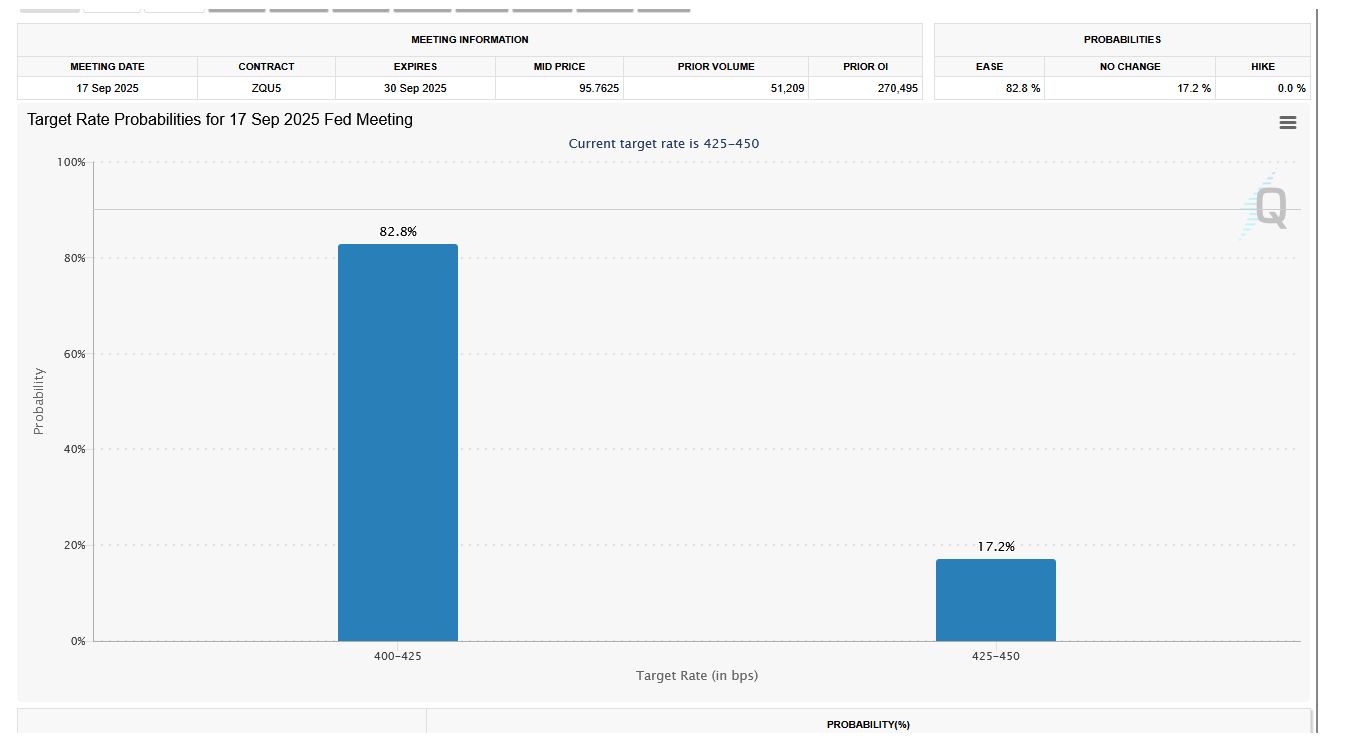

All eyes will be on Fed Chair Jerome Powell's pivotal speech, expected to offer crucial insights into the Fed's stance on inflation and future rate trajectory. The market's high probability of a September rate cut faces a critical test.

Meanwhile, the market largely discounts a breakthrough in the Russia/Ukraine conflict.

Yet, any unexpected progress on a peace deal, particularly if brokered by figures Trump, could trigger a massive boost to global markets, acting as an unforeseen tailwind that current sentiment simply isn't pricing in.

This is a credibility test for consensus geopolitical forecasts.

Yields & The Looming “Haircut Cycle”

Despite a concerning surge in the services Producer Price Index (PPI), which traditionally pushes yields higher, the market’s conviction for a September rate cut remain at nearly 80%.

|

This dissonance signals a profound shift: rate cuts are firmly on the horizon, likely initiating a “haircut cycle” in 2025-2026.

Current yields are considered “way below where we were earlier,” posing no significant headwind unless they breach the 4.5% threshold. This is a conviction test for the bond market’s pricing power.

SLR Relaxation Boosting Liquidity & AI's Unstoppable Advance

The increasing global money supply acts as a powerful tailwind, fueling the current market momentum.

Further, the anticipated relaxation of the Supplementary Leverage Ratio (SLR) is poised to incentivize banks to acquire more bonds and issue loans, injecting substantial liquidity.

|

This marks the definitive end of a tight monetary cycle and the dawn of a global easing cycle, suggesting that asset performance “can only get better from here.”

Concurrently, the AI trade remains exceptionally strong, with titans like Nvidia, Meta, Apple, and Microsoft consistently scaling new highs and driving the NASDAQ to unprecedented levels.

|

Proflex Macro Discussion Group

|

🧭 Proflex Playbook – Discipline in a Liquidity-Driven Market

While some new IPOs are undoubtedly “overvalued,” the unprecedented pace of global money creation and concentrated investments in popular assets suggest there’s “no top” yet for the broader market.

However, with even major companies experiencing 50-70% crashes in past cycles, robust risk management is paramount

Our stance stays anchored in the data:

✅ Stay Long Hard Assets — Bitcoin, gold, and silver have front-run policy

✅ Trade Equities Tactically — Let earnings decide who earns the premium

✅ Hedge for Volatility — Tariffs + Fed + FX = high optionality zone

✅ Monitor Fed Tone Closely — Be prepared for bond market volatility driven by Powell's guidance, not policy action.

If you're an All-Access or Managed Portfolio subscriber, our positioning has already shifted ahead of this moment—scaling up asymmetric hard asset plays while hedging for earnings volatility and geopolitical tail risks.

| Proflex All-Access Subscription (Yearly) |

| Proflex All-Access Subscription (Monthly) |

Until next week,

— The Proflex Team

Trusted Macro Insights. Calm Investing. Tactical Trades.

Legal Disclosures

Blockstart Research Proflex Series

ProFlex® is designed to optimize your time, ignite your investment IQ, and maximize your financial potential.