ProFlex® is designed to optimize your time, ignite your investment IQ, and maximize your financial potential.

Proflex Wk 35 – Powell's Pivot, Tech Concentration, Altcoin Boom

|

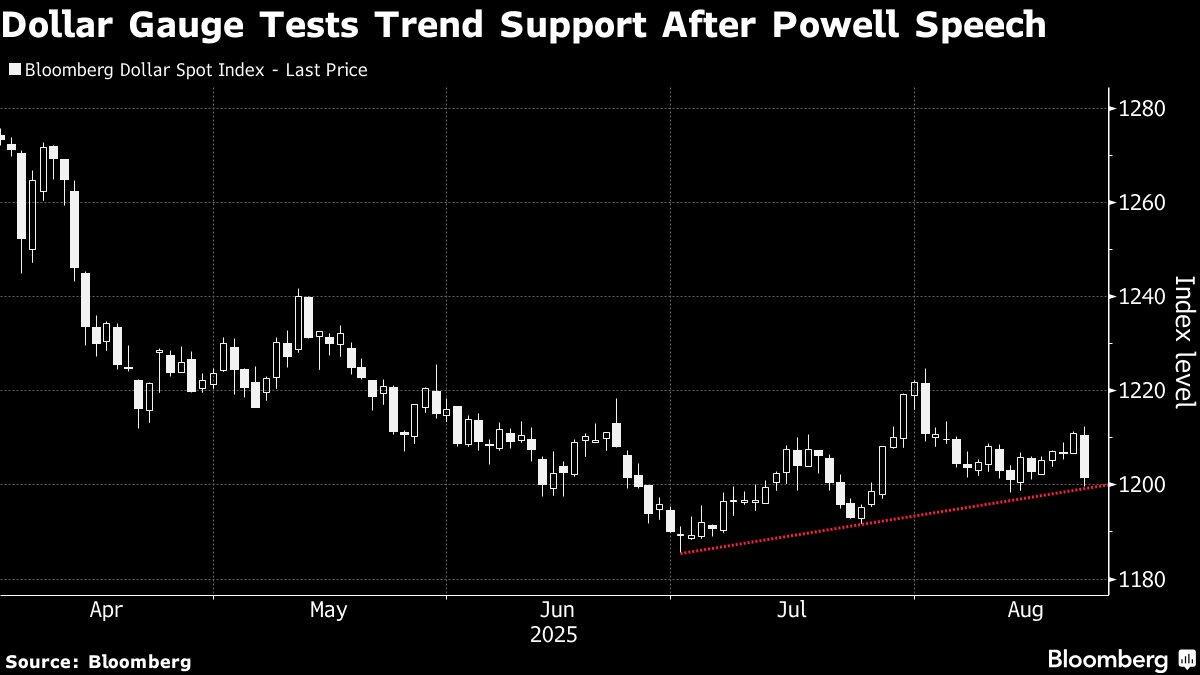

Proflex Market Update - Wk 35 “The Fed’s 2% target was always a mirage. Now, the market is finally seeing past it, betting on cuts, not dogma.” The past week marked a historic inflection point in Federal Reserve policy as Powell delivered his most dovish Jackson Hole address in years, fundamentally shifting market expectations around monetary policy.

While the S&P nears all-time highs driven by the “AI world,” the broader economy lags, and yields continue their downward trend.

Insights for Proflex Weekly Macro Call

|

|

Proflex All-Access Gain monthly access to our full research suite—and join a thriving investor community alongside 100+ Big Tech Executives and fund managers from Silicon Valley and beyond.

|

Key Drivers This Week

Historic Jackson Hole Pivot & Softening Fed Stance

The recent Jackson Hole conference and Chair Powell's press conference are being viewed as a historic day, with the market largely interpreting them as dovish, leading to a definitive "Jackson Hole pivot."

Rate cuts are now widely expected, with a September rate cut almost "locked in" by futures markets. Depending on August employment reports, the market may even start betting on a 25 versus 50 basis point cut.

The Fed now has flexibility, considering the inflation target "well anchored," not necessarily fixed at 2%. This implies a rate cut cycle, with the market positioning for more than two, possibly three, cuts within the next three to four meetings.

AI-Driven Market Rally Diverges from Wider Economy

The market is back to almost all-time highs, particularly driven by tech stocks. While the S&P is at these new peaks, NASDAQ still has room to run, indicating recent corrections were more pronounced in tech.

The concentration risk appears historically extreme. Five stocks accounted for the majority of market capitalization increases in July, with Nvidia alone adding approximately $900 billion in value following China export license restoration.

|

The economy is currently split into "AI world" and "no AI world." This is an "AI bull market," not a wider economy bull market.

This market-pricing extreme suggests that any disappointment in AI monetization or broader economic growth could trigger significant corrections.

Nvidia's earnings report next week is critical. As the highest market cap company and a bellwether for tech, expectations are high, but concerns linger regarding H20 shipments and guidance on the China front.

Yields Signal Economic Slowdown Amidst "Bad News is Good News" Dynamic

Yields have been trending downwards since the start of the year and dropped further after the Jackson Hole news.

|

A softer stance from the Fed and market expectations for much lower rates in the future are being priced in by the markets as the bond market, often referred to as "real money," is signaling a need for softer, lower rates.

This implies an expectation of an economic slowdown, potential concerns about declining earnings, and rising unemployment & the unusual "bad news is good news" phenomenon:

If unemployment rises or job numbers are bad, the market celebrates because it expects interest rates to go down, prompting further buying of risk assets due to abundant "money printing."

Bitcoin Undergoing a "Healthy Test" as Altcoin Treasuries Boom

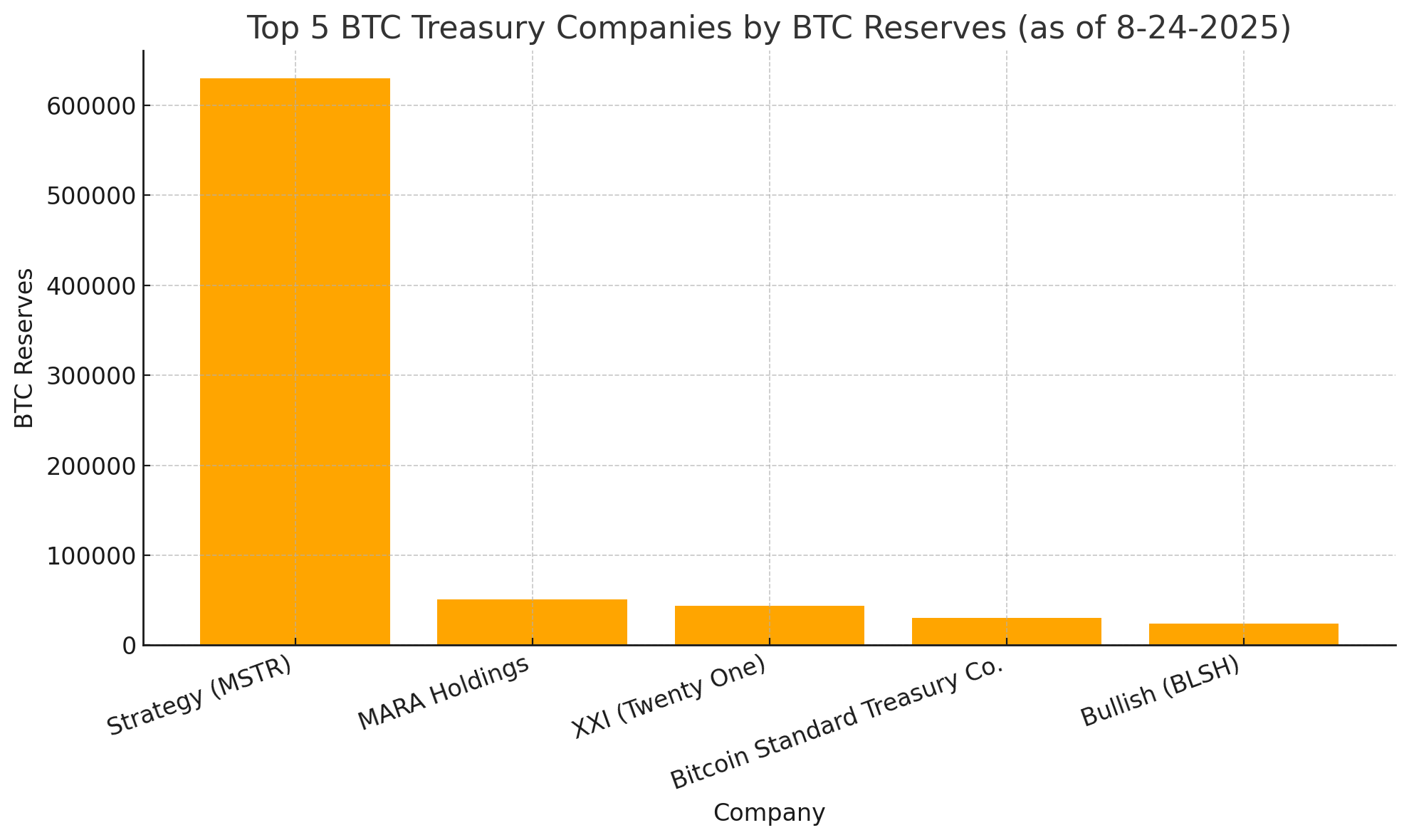

Bitcoin has been weaker than the S&P, currently consolidating around its previous all-time high support level. This cycle was largely driven by MicroStrategy's continuous Bitcoin purchases and its "digital gold" narrative.

|

The significant "anchor-factor" here: MicroStrategy recently paused its regular Bitcoin purchases for the first time in months.

Shortly after, management reversed prior guidance and scrapped its long-standing pledge not to issue new stock when its Market Value of Net Assets (mNAV) falls below 2.5x.

With mNAV now around 1.6—down sharply from peaks above 3.4 just a year ago—the company has adopted a more flexible capital-raising approach, even at lower valuation premiums.

This shift is widely seen as strategic, conserving resources while positioning the company for potential S&P 500 inclusion, which could attract passive inflows and "institutional FOMO" as traditional allocators gain indirect Bitcoin exposure.

The recent correction is therefore being interpreted as a “healthy test” of organic Bitcoin demand outside of MicroStrategy’s buying influence.

Meanwhile, Ethereum and other altcoins (like Solana and Binance Coin) are experiencing a boom with new "treasury companies," acting as the "new shiny thing" and drawing capital away from Bitcoin. Ethereum has been making new highs while Bitcoin consolidates, indicating a rotation of capital.

|

Proflex Macro Discussion Group

|

🧭 Proflex Playbook – Rate Cuts Are Here, Capital Rotation Next

The market has called the Fed's bluff, pivoting decisively towards rate cuts and acknowledging a flexible inflation target.

This shifts the focus from monetary policy uncertainty to capital allocation within a "new normal" of easing.

Our stance stays anchored in the data:

✅ Stay Long Hard Assets — Bitcoin, gold, and silver have front-run policy

✅ Trade Equities Tactically — Let earnings decide who earns the premium

✅ Hedge for Volatility — Tariffs + Fed + FX = high optionality zone

✅ Monitor Fed Tone Closely — Be prepared for bond market volatility driven by Powell's guidance, not policy action.

If you're an All-Access or Managed Portfolio subscriber, our positioning has already shifted ahead of this moment—scaling up asymmetric hard asset plays while hedging for earnings volatility and geopolitical tail risks.

| Proflex All-Access Subscription (Yearly) |

| Proflex All-Access Subscription (Monthly) |

Until next week,

— The Proflex Team

Trusted Macro Insights. Calm Investing. Tactical Trades.

Legal Disclosures

Blockstart Research Proflex Series

ProFlex® is designed to optimize your time, ignite your investment IQ, and maximize your financial potential.