ProFlex® is designed to optimize your time, ignite your investment IQ, and maximize your financial potential.

Proflex Wk 36 – Apple’s Moment, Rate Cut bets, Gold Breakout

|

Proflex Market Update - Wk 36

“The Street is pricing in rate cuts as a done deal, but the real leverage lies in understanding where true capital flows—not just sentiment—are driving the market”

US markets closed August on a strong note, with the S&P 500 up 1.91% Month to Date despite pressure from weak jobs data and new tariffs.

Insights for Proflex Weekly Macro Call

|

|

Proflex All-Access (Price Hike to $799 from October 15)

|

Key Drivers This Week

Macro Tailwinds & The Rate Cut Dilemma

Despite recent hotter-than-expected PCE numbers, market probabilities for a September 17 rate cut remain high at 87%, with an additional 47% chance for another cut in October.

The yields on bonds, like the 2-Year, 10-year yield, are aggressively dropping, signaling a decreasing cost of capital.

|

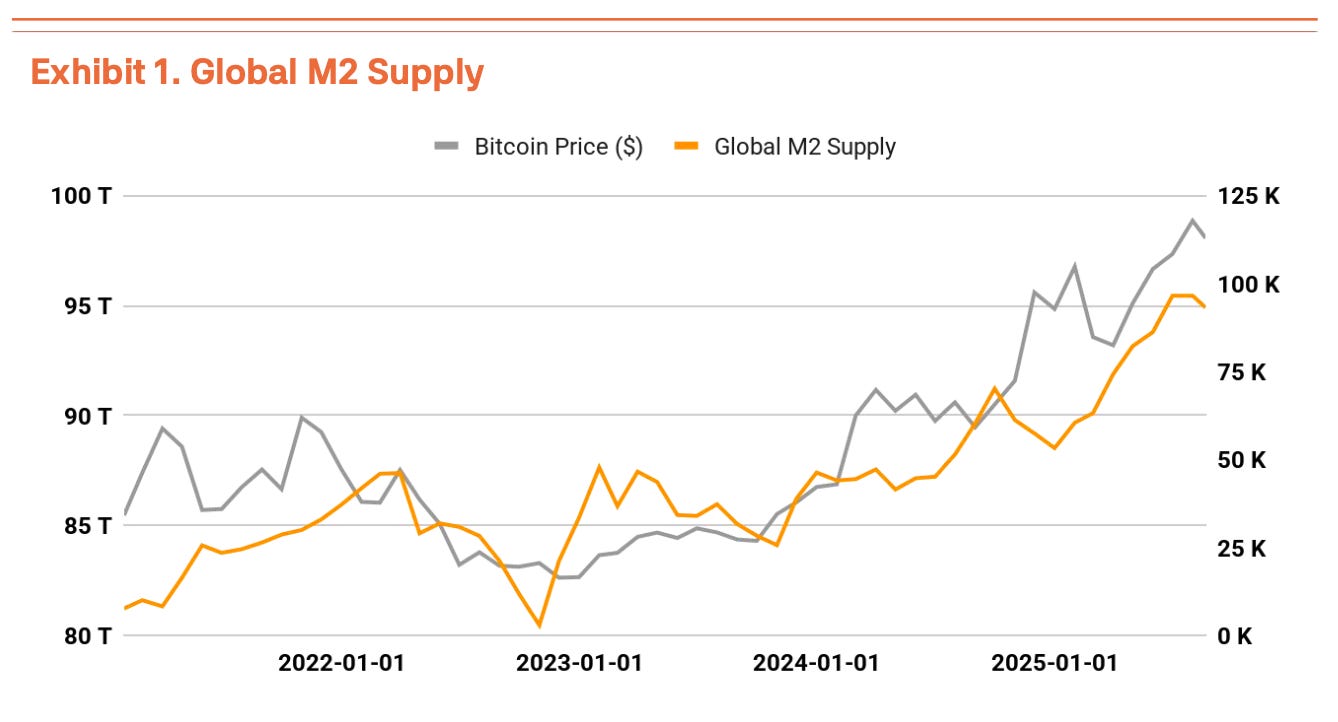

This makes investment opportunities far more attractive, providing a powerful tailwind for economic activity and risk assets. Coupled with sustained double-digit percentage growth in money supplies globally, the environment is ripe for asset price appreciation.

Existing policies, including relaxed SLR rules from the Trump administration, also encourage banks to expand credit, further fueling the economy.

Tech Sector: AI's Second Wind & Apple's Moment

The market’s growth story is broadening out. Big tech companies are still spending heavily on new infrastructure, showing confidence in long-term demand.

|

Nvidia continues to post outstanding results—up 56% last quarter and guiding for another 54% this quarter—even without counting possible China sales. Its ability to grow despite restrictions shows strong underlying demand.

We’re also seeing a rotation within tech. While leaders like Nvidia have run far, companies such as Apple and Google are starting to close the gap. Apple’s new iPhone launch in about 10 days could be a major spark, especially if it highlights new features that excite consumers and investors alike.

Unlike its peers, Apple hasn’t yet reached record highs, leaving more room for upside. Its brand and reach give it unique advantages as it explores new opportunities and partnerships.

Finally, the expected rate cut cycle will add more support for company growth and stock prices across the board, extending gains beyond just a few mega-caps.

Crypto & Precious Metals: Breakouts Beyond Belief

Bitcoin remains closely tied to global money supply trends, making the upcoming rate cut cycle a major potential catalyst.

|

While the recent drop below its $112K peak was a technical setback, the bigger picture stays constructive as long as it trades above its 200-day moving average.

Importantly, the market is comfortably absorbing new supply from older wallets (Satoshi Era), and ETF giants like BlackRock and Fidelity continue to attract strong inflows.

Gold has broken out after a four-month consolidation, a strong technical signal that reflects growing demand amid money supply expansion and macro tailwinds. It is now on the verge of new all-time highs.

Silver is also showing momentum, historically amplifying gold’s moves later in the cycle. Some silver miners have already returned 70–80% YTD gains promising sector strength.

Key Watchpoints: The Next Few Weeks Decide Everything

The market is now entering a high-stakes period packed with catalysts that will define the second half of the year. From macroeconomic signals to corporate events, each data point will feed into investor psychology and asset repricing.

Key Catalysts Ahead:

- Unemployment Data: A supportive jobs print could cement expectations for a 25 bps rate cut, adding fuel to the risk-asset rally.

- FOMC Meeting (Sep 16–17): Perhaps the most pivotal event—forward guidance here will shape not just September’s reaction but the broader trajectory of policy into year-end.

- Apple iPhone Launch (~10 days): The spotlight is on Apple’s AI ambitions. A strong unveiling could reinvigorate mega-cap tech momentum.

- Nvidia’s China Approvals: Potential clearance to ship H20 chips to China would add a new tailwind for Nvidia and ripple through broader tech indices.

|

Proflex Macro Discussion Group

|

🧭 Proflex Playbook – Rate Cuts Are Here, Capital Rotation Next

We're seeing a re-pricing for a new regime of cheaper capital and robust liquidity. Consensus is still underestimating the breadth of this move.

Our stance stays anchored in the data:

✅ Stay Long Hard Assets — Bitcoin, gold, and silver have front-run policy

✅ Lean into AI's Second Wave — Beyond core leaders, look for rotation into "laggard" tech names like Apple that have significant upside.

✅ Position for Deeper Rate Cuts — Despite contrarian voices, the market is pricing in cuts, and this liquidity injection will fuel risk assets.

✅ Actively Manage Risk Around Key Events — The FOMC meet and Apple launch present immediate volatility and opportunity.

If you're an All-Access or Managed Portfolio subscriber, our positioning has already shifted ahead of this moment—scaling up asymmetric hard asset plays while hedging for earnings volatility and geopolitical tail risks.

| Proflex All-Access Subscription (Yearly) |

| Proflex All-Access Subscription (Monthly) |

Until next week,

— The Proflex Team

Trusted Macro Insights. Calm Investing. Tactical Trades.

Legal Disclosures

Blockstart Research Proflex Series

ProFlex® is designed to optimize your time, ignite your investment IQ, and maximize your financial potential.