ProFlex® is designed to optimize your time, ignite your investment IQ, and maximize your financial potential.

Proflex Wk 38 — Fed Cuts Begin, Gold Breaks Out, Q3 Earnings Loom

|

Proflex Market Update - Wk 38

“The greatest risk isn't overvaluation but underestimating the persistent power of cheap money and strategic capital rotation.” Last week saw markets continue their impressive bull run, with the S&P hitting significant new highs, fueled by the tech rotation & Fed's dovish update that we’ve consistently highlighted since the Jackson Hole pivot.

Proflex Investor Day — October 5, 2025Our quarterly Investor Day has become one of the most valuable learning and networking experiences for our community. At these events, we’ve shared the mega trends shaping markets and paired them with clear, actionable strategies for investors. We’ll walk you through macro trends, options frameworks, income & hedging strategies, and mindset tools — with curated networking to sharpen your playbook. 📅 Date: Sunday, October 5, 2025

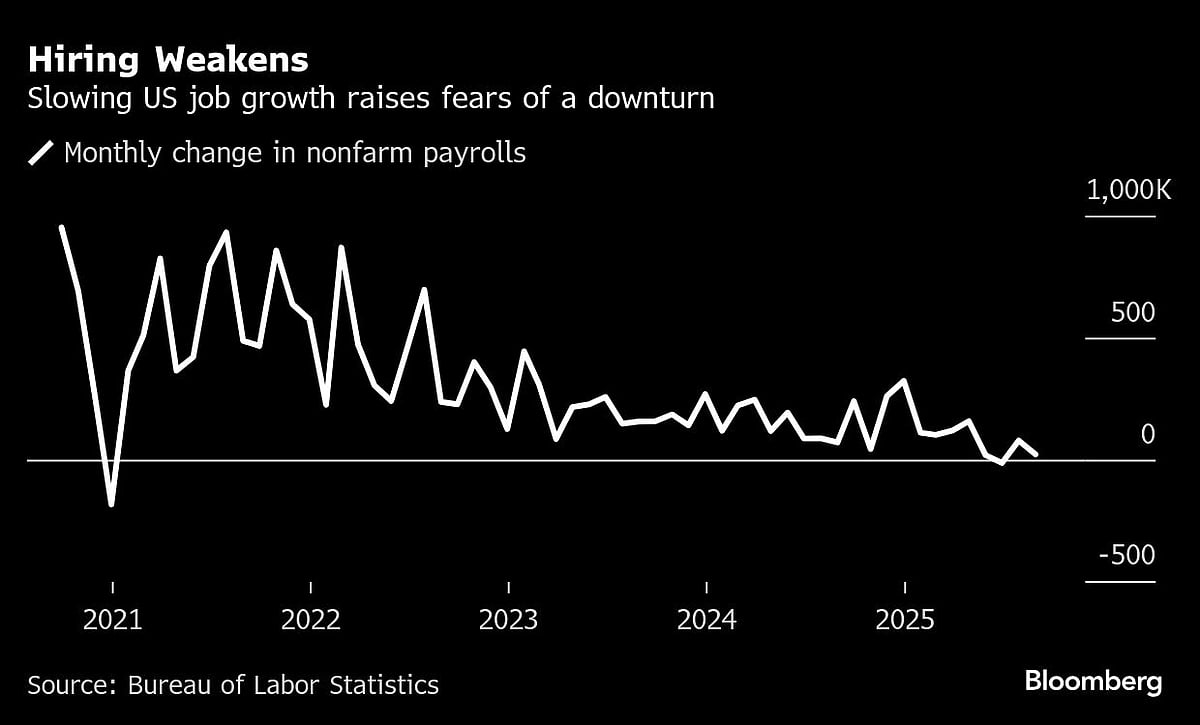

Key Drivers This WeekFed Policy Pivot: Cuts Confirmed, Unemployment in Focus As widely anticipated, the Federal Reserve initiated its rate-cutting cycle in September 2025, reducing the federal funds rate by 25 basis points to a new range of 4.00%–4.25%.

The Fed’s “dot plot” now signals further easing, with a median expectation for the fed funds rate to fall to a range of 3.5%–3.75% by the end of 2025, indicating that this is merely the first cut in a series.

Proflex Takeaway: “The Fed has removed the tightening threat; now the market decides how much growth it can build on declining rates.”

Gold's Rally: A Leading Indicator of Asset Inflation Gold has continued its robust rally, serving as a powerful leading indicator for the broader asset inflation that lies ahead.

Q3 Earnings: The Next Litmus Test for Momentum With the immediate Fed uncertainty removed, the market’s focus will soon pivot to Q3 earnings season, set to begin in roughly a month.

The market's enthusiasm for rate cuts and tech leadership is palpable, but tactical caution is warranted in the short term. Our stance remains anchored in identifying structural macro tailwinds while sidestepping immediate risks. Our stance stays anchored in the data: ✅ Stay Long Hard Assets — Bitcoin, gold, and silver have front-run policy

“The next move won’t be slow. Smart money is already positioned—are you?”

Proflex All-Access: Your Market Compass

Explore the financial markets with Proflex All-Access, your comprehensive resource for deeper market understanding and active participation. This premium service offers subscribers exclusive insights and actionable investment advice, giving you a significant edge in various market conditions.

Proflex All-Access provides detailed analyses and recommendations to optimize your investment strategy. Our specialized newsletters include:

• Growth Gazette: Aimed at achieving above-market returns for aggressive portfolio growth.

• Income Insider: Focused on conservative strategies and income generation for yield-seeking investors.

• Crypto Pulse: Offers advanced strategies for investing in the rapidly expanding cryptocurrency market.

Until next week,

ProFlex® by Blockstart Research

Legal Disclosures ProFlex® by Blockstart Research, the premium newsletter product series, provides informational and educational content only and does not offer personalized investment advice or establish a fiduciary relationship. While we rely on reliable sources and research, the information is not tailored to individual financial situations. Readers are urged to consult qualified financial professionals before making investment decisions. We do not guarantee the accuracy, completeness, or timeliness of the information and are not responsible for any investment decisions based on this newsletter. Investing carries risks, and past performance doesn't predict future results. By accessing this newsletter, you acknowledge that we are not liable for actions or decisions resulting from its content. Please conduct due diligence and seek professional advice as needed.

|

Blockstart Research Proflex Series

ProFlex® is designed to optimize your time, ignite your investment IQ, and maximize your financial potential.