ProFlex® is designed to optimize your time, ignite your investment IQ, and maximize your financial potential.

Proflex Wk 38: FOMC Ahead, iPhone China Boom, Hard Assets Rally

|

Proflex Market Update - Wk 38

"The market has priced the cuts. Now, it waits for confirmation. The Fed's September decision about validating the entire risk-on narrative."

US markets finished last week at record highs, with the S&P 500 gaining approximately 1.6% and the Nasdaq climbing about 2% for the week. These advances came as investors grew increasingly confident rate cut in September, driven by softening labor market data and dovish commentary from central bank officials. Meanwhile, Apple's iPhone 17 is defying initial skepticism with blockbuster pre-orders in China, potentially reigniting tech enthusiasm.

Proflex View: While consensus fears a "buy the rumor, sell the news" reaction to an anticipated Fed cut, our view is that genuine policy easing could fuel a sustained rally, especially if short-term yields drop, making equities more attractive.

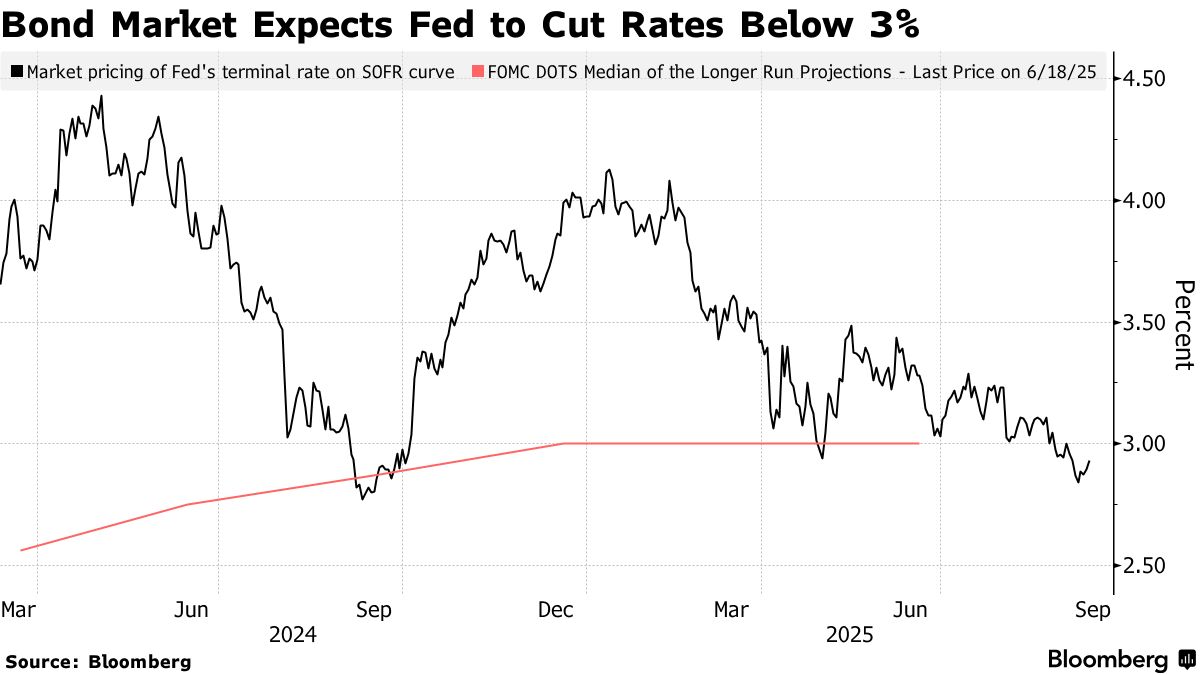

Key Drivers This WeekFOMC's September Dilemma: Will the Fed Deliver the Cuts? Bond Markets have already priced in three rate cuts for the remainder of 2025, sending the S&P 500 to new records and the S&P breaking out to fresh highs.

Proflex Takeaway: "The Street's biggest mistake right now is underestimating the power of a coordinated easing cycle. The Fed is now actively responding to global pressure and political imperative. This isn't just 'one cut' — it's about signaling a new regime." Apple's iPhone Launch : China Pre-Orders Signal Strong Demand Initial market reaction to the iPhone 17 launch was muted, but over the weekend, pre-order data painted a dramatically different picture, especially from China.

Proflex Takeway: "If Apple can sustain this momentum and navigate geopolitical hurdles in its other biggest markets like China, its performance could provide a critical tailwind, potentially breaking the Nasdaq to newer upside."

Bitcoin & Precious Metals: The Unrelenting Bull Run Continues After a period of consolidation and underperformance, Bitcoin has seen a significant turnaround last week, aligning with the sustained rally in gold and silver. Bitcoin's reversal follows a period of consolidation, indicating renewed institutional and retail interest.

Proflex Takeaway: "The consistent growth in global money supply is a foundational driver, sustaining rallies across all asset classes." Missed Bitcoin's reversal last week?

The market is poised, waiting for the Fed to either confirm or deny the aggressive pricing of future rate cuts. Our stance remains clear: leverage validated trends and prepare for tactical shifts. Our stance stays anchored in the data: ✅ Stay Long Hard Assets — Bitcoin, gold, and silver have front-run policy Proflex All-Access: Your Market Compass

Explore the financial markets with Proflex All-Access, your comprehensive resource for deeper market understanding and active participation. This premium service offers subscribers exclusive insights and actionable investment advice, giving you a significant edge in various market conditions.

Proflex All-Access provides detailed analyses and recommendations to optimize your investment strategy. Our specialized newsletters include:

• Growth Gazette: Aimed at achieving above-market returns for aggressive portfolio growth.

• Income Insider: Focused on conservative strategies and income generation for yield-seeking investors.

• Crypto Pulse: Offers advanced strategies for investing in the rapidly expanding cryptocurrency market.

Until next week,

ProFlex® by Blockstart Research

Legal Disclosures ProFlex® by Blockstart Research, the premium newsletter product series, provides informational and educational content only and does not offer personalized investment advice or establish a fiduciary relationship. While we rely on reliable sources and research, the information is not tailored to individual financial situations. Readers are urged to consult qualified financial professionals before making investment decisions. We do not guarantee the accuracy, completeness, or timeliness of the information and are not responsible for any investment decisions based on this newsletter. Investing carries risks, and past performance doesn't predict future results. By accessing this newsletter, you acknowledge that we are not liable for actions or decisions resulting from its content. Please conduct due diligence and seek professional advice as needed.

|

Blockstart Research Proflex Series

ProFlex® is designed to optimize your time, ignite your investment IQ, and maximize your financial potential.