ProFlex® is designed to optimize your time, ignite your investment IQ, and maximize your financial potential.

Proflex Wk 39 — Goldilocks Tailwinds, AI Capex Check, Shallow Pullbacks

|

Proflex Market Update - Wk 39

"Markets are inching towards a “goldilocks” phase — steady growth, easing inflation, and supportive policy creating a balanced backdrop for markets."

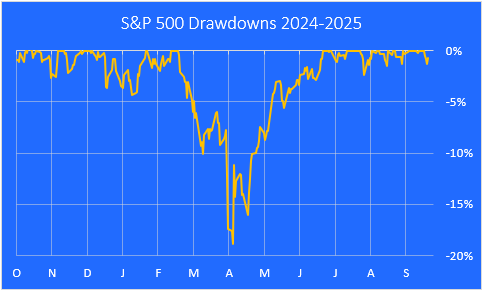

The market continues its confounding dance, with shallow corrections that refuse to stick, signaling robust underlying liquidity and bullish sentiment.

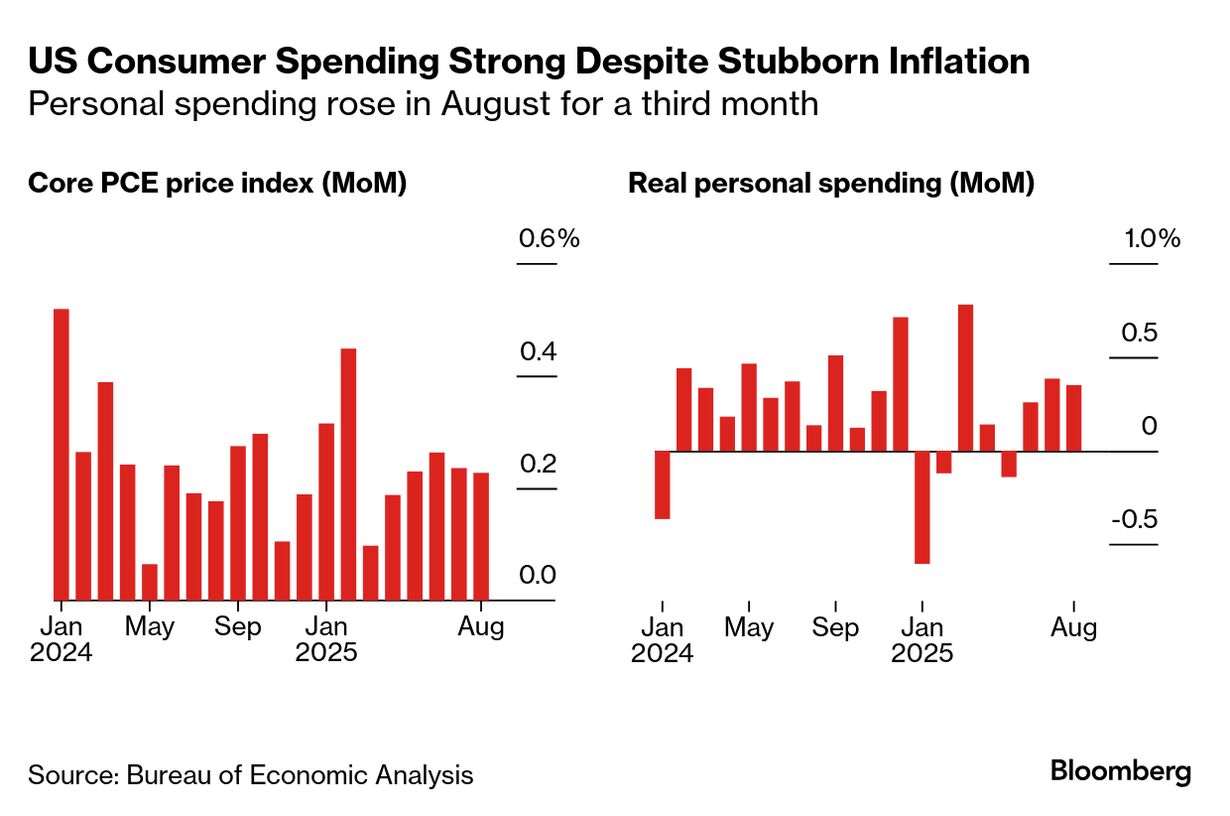

August PCE inflation came in at 2.7%, with Core PCE at 2.9% — both the highest since February but exactly in line with expectations.

Crucially, a dovish macroeconomic shift, underscored by easing inflation data and impending rate cuts, promises to provide a significant tailwind for the broader market beyond the current AI leaders. Insights from the Proflex Macro Call

On the call, we dug into why these “non-sticking” corrections aren’t a fluke but a reflection of how much liquidity is sitting underneath this market. 📅 Sunday, October 5, 2025

Key Drivers This Week The macro environment is sending a clear message: tailwinds are strong and supportive.

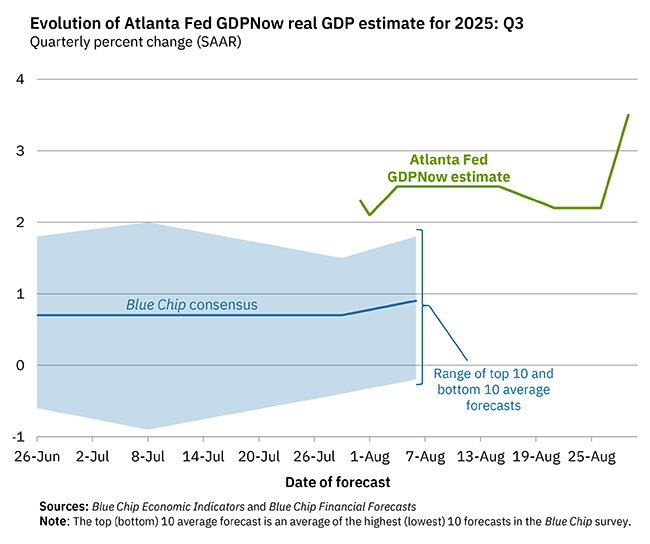

With inflation stable and the market pricing in an 88–90% probability of another Fed rate cut in October, policy is clearly moving toward further easing. Short-term rates are falling while long-term yields remain contained, a powerful combination that supports higher equity valuations without stoking fears of runaway inflation. On top of that, the biggest tariff-related worries haven’t shown up in the inflation data, easing geopolitical pressure. All of this points to a deeply supportive backdrop for U.S. equities, particularly over the medium to long term.

Proflex Takeaway: "The setup is clear: stable inflation, falling rates, and fading tariff fears are creating one of the most constructive macro backdrops in years."

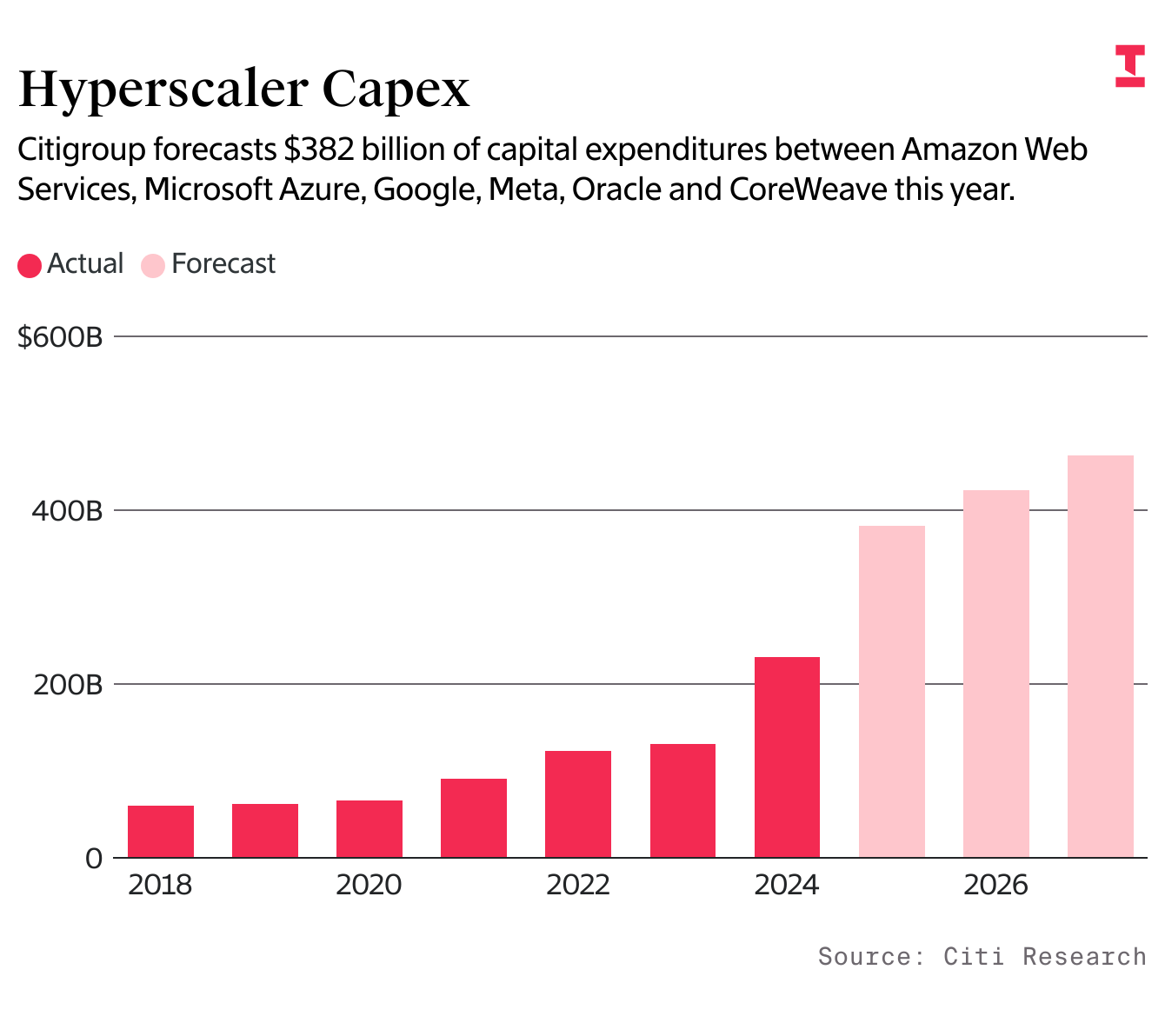

AI Dominance: The Unstoppable Spending Cycle The AI rally remains the undisputed "biggest trend" and the primary engine of market growth, being an intergral part of a multi-decade expansion cycle.

The spending forecasts are staggering, indicating "continued spending all the way up to 2030," confirming that this expansion cycle is barely in its middle stages.

Proflex Takeaway: “The Fed has removed the tightening threat; now the market decides how much growth it can build on declining rates.”

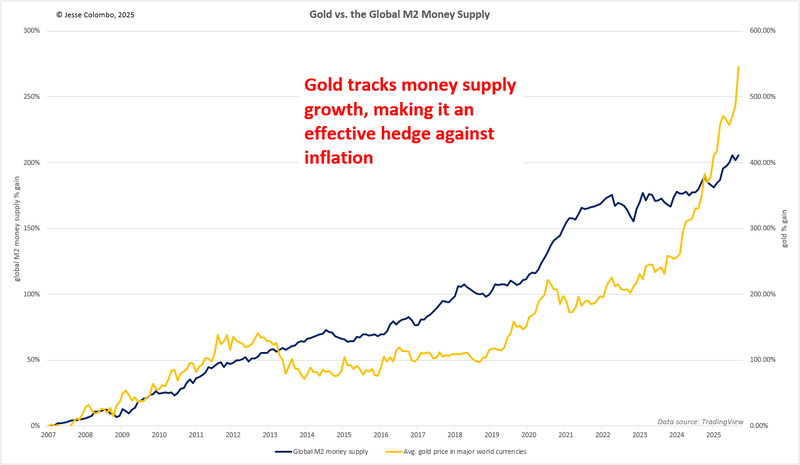

Divergent Asset Classes: Gold, Metals, Bitcoin & Realty While equities continue to surge on the back of the AI wave, other asset classes are telling a more divergent story. This “decorrelation” is important — it reveals how capital is repositioning across different parts of the market rather than moving in lockstep. Gold and Precious Metals have quietly led the charge, with gold tracking money supply growth better than almost any other asset.

Bitcoin is consolidating sideways, behaving more like “digital gold” than a speculative instrument. Its modeling has become far more stable compared to the volatile altcoin universe, reinforcing its role as a core macro asset rather than a trading frenzy.

"Proflex Takeaway: Different asset classes are marching to their own beat — a reminder that real diversification matters, especially in shifting macro cycles."

We are at a critical inflection point where disciplined planning and robust mental models separate real performance from speculative noise. The market is not forgiving of FOMO without a coherent strategy. Our stance remains clear and decisive:

Proflex All-Access: Your Market Compass

Explore the financial markets with Proflex All-Access, your comprehensive resource for deeper market understanding and active participation. This premium service offers subscribers exclusive insights and actionable investment advice, giving you a significant edge in various market conditions.

Proflex All-Access provides detailed analyses and recommendations to optimize your investment strategy. Our specialized newsletters include:

• Growth Gazette: Aimed at achieving above-market returns for aggressive portfolio growth.

• Income Insider: Focused on conservative strategies and income generation for yield-seeking investors.

• Crypto Pulse: Offers advanced strategies for investing in the rapidly expanding cryptocurrency market.

Until next week,

ProFlex® by Blockstart Research

Legal Disclosures ProFlex® by Blockstart Research, the premium newsletter product series, provides informational and educational content only and does not offer personalized investment advice or establish a fiduciary relationship. While we rely on reliable sources and research, the information is not tailored to individual financial situations. Readers are urged to consult qualified financial professionals before making investment decisions. We do not guarantee the accuracy, completeness, or timeliness of the information and are not responsible for any investment decisions based on this newsletter. Investing carries risks, and past performance doesn't predict future results. By accessing this newsletter, you acknowledge that we are not liable for actions or decisions resulting from its content. Please conduct due diligence and seek professional advice as needed.

|

Blockstart Research Proflex Series

ProFlex® is designed to optimize your time, ignite your investment IQ, and maximize your financial potential.