ProFlex® is designed to optimize your time, ignite your investment IQ, and maximize your financial potential.

Proflex Wk 40 — Strong September, Shutdown Shock, Dovish Tailwinds

|

Proflex Market Update - Wk 40 Special shoutout to all of you who’ve been recommending Proflex to friends, family, and colleagues — it’s the strongest endorsement we could ask for. We’re committed to continuing to build something meaningful together, one thoughtful conversation at a time. Weekly Macro Landscape

|

|

This exceptional run, in what is typically a weak month, was fueled by renewed AI optimism and improving earnings momentum.

The government shutdown beginning October 1 created the biggest economic data disruption in years, delaying key reports like September employment.

Yet, despite these headwinds, assets showed striking resilience. Gold and Bitcoin broke new records, reflecting shifting macro dynamics and growing investor demand for hard-asset hedges.

Looking ahead, markets are positioned for upcoming Fed rate cuts, with attention turning to Q3 earnings to assess whether current valuations can hold in this evolving backdrop.

|

Proflex All-Access (Price Hike to $799 from October 15)

|

Key Drivers This Week

Government Shutdown Creates Critical Data Blackout

The U.S. government shutdown is sending a different kind of signal: uncertainty has spiked just as policymakers were looking for clarity.

|

The legislative impasse over healthcare subsidies triggered the biggest data blackout in years, delaying the critical September jobs report.

In its absence, markets leaned on ADP data, which showed a surprise loss of 32,000 jobs — a sharp contrast to prior momentum and a clear warning sign.

The economic impact is real. Fox Business estimates billions in taxpayer costs, the White House flagged 43,000+ potential job losses.

With official data missing, policymakers are navigating blind. This increases the pressure to stay accommodative, reinforcing the Fed’s dovish tilt at a time when markets are seeking stability.

Fed's October Cut Solidifies

Despite the data blackout, or perhaps because of it, Fed policy expectations quickly firmed around further easing.

Markets are pricing in a 98% probability of a 25 bps cut at the October 29–30 meeting and a 90% chance of another in December.

|

Powell’s framing of the September cut as a “risk management” move reinforced this outlook, keeping the policy window wide open as the U.S. economy diverges from recessionary trends in Europe and China.

Precious Metals & Bitcoin Shatter Records

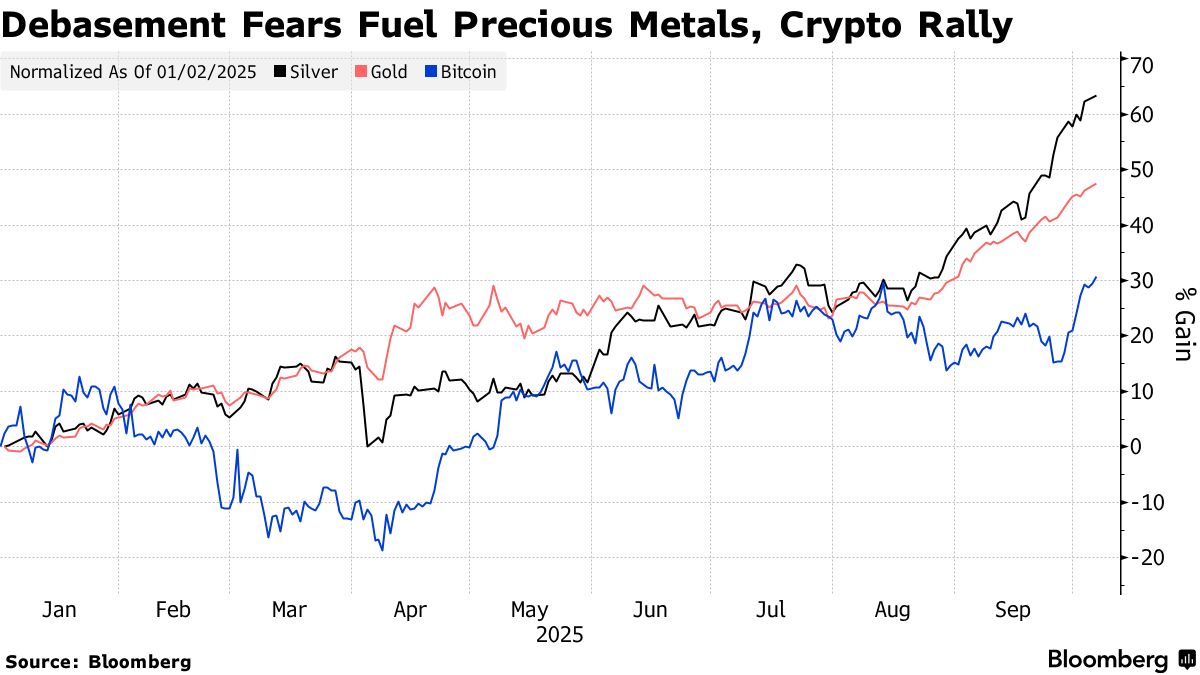

Precious metals and crypto stole the spotlight. Gold broke $3,800/oz, silver surged past $48/oz, and Bitcoin hit $125,000, powered by $3.2 billion in ETF inflows.

|

These moves highlight a clear investor shift toward hard-asset hedges amid financial uncertainty.

Oil, meanwhile, moved the other way. WTI slid to $60.90, down 7% on the week, as expectations of higher OPEC+ output, refinery maintenance, and softer growth weighed on prices.

🧭 Proflex Playbook – Navigating Q4 Complexity

The market's resilience this week, despite significant political and economic uncertainties, suggests a strong underlying bid.

However, the data blackout and the widening divergences across asset classes demand a refined strategy for Q4.

Our stance remains clear and decisive:

- Focus on Structural Growth: Continue to overweight the secular AI theme, recognizing its multi-year runway.

- Anticipate Shallow Corrections: Use dips as accumulation opportunities, not reasons for fear, understanding that "none of the corrections stick."

- Diversify Thoughtfully: Recognize the "decorrelation" across asset classes; consider gold and Bitcoin for portfolio resilience.

- Develop Mental Models: Prioritize long-term planning (6-12 months out) over short-term news, aiming for consistent, incremental gains.

If you're an All-Access or Managed Portfolio subscriber, our positioning has already shifted ahead of this moment—scaling up asymmetric hard asset plays while hedging for earnings volatility and geopolitical tail risks.

| Proflex All-Access Subscription (Yearly) |

| Proflex All-Access Subscription (Monthly) |

Until next week,

— The Proflex Team

Trusted Macro Insights. Calm Investing. Tactical Trades.

Legal Disclosures

Blockstart Research Proflex Series

ProFlex® is designed to optimize your time, ignite your investment IQ, and maximize your financial potential.