ProFlex® is designed to optimize your time, ignite your investment IQ, and maximize your financial potential.

Proflex Wk 41 — Froth Flush, Tariff Shock, Dovish Undercurrent

|

Proflex Market Update - Wk 41 Market Volatility | Geopolitical Pressures | AI's Unwavering Momentum

“The market just needed to exhale. What others call a crash, we call a necessary cleansing of the system.”

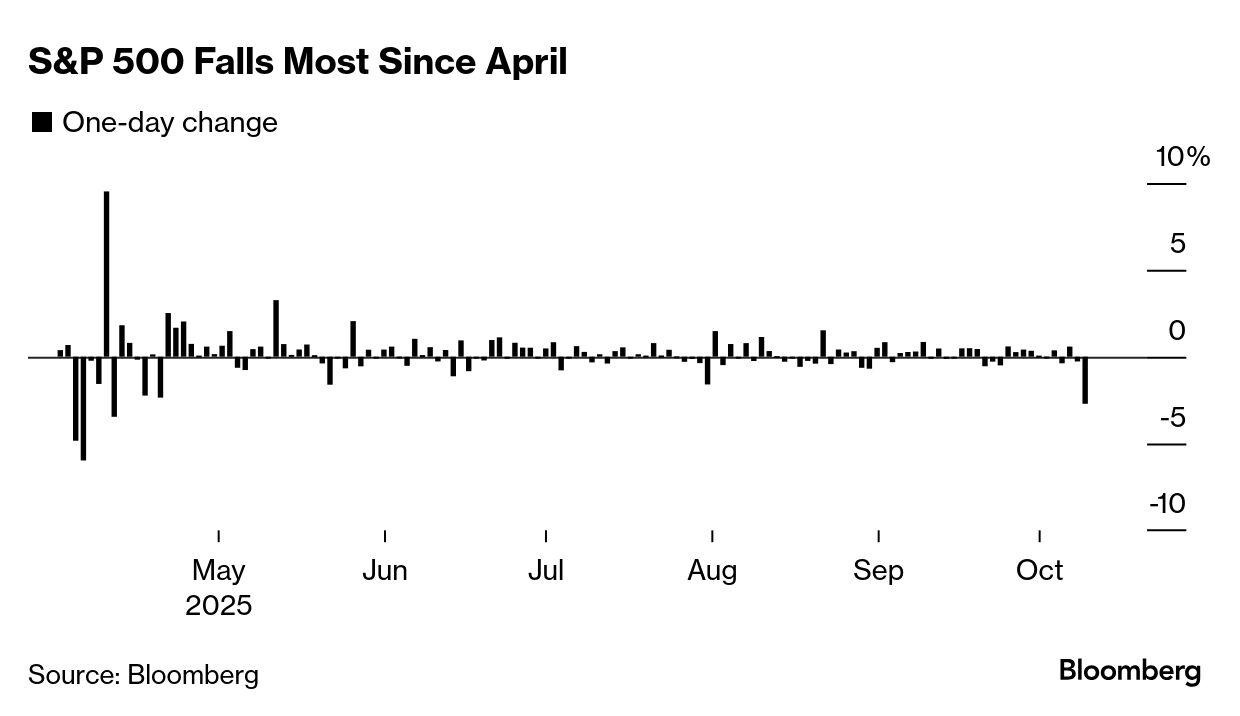

The past week witnessed a significant market drawdown, described by some as "Liberation Day 2," with the S&P plunging 2.5% – one of its sharpest declines this year.

Insights from Proflex Macro Call

|

|

Proflex All-Access (Price Hike to $799 from October 15)

|

Key Drivers This Week

Leverage Unwinds Trigger "Liberation Day 2"

The market’s sharp decline, epitomized by the S&P's ~2.7% drop, was a direct consequence of high leverage meeting a sudden shift in sentiment.

|

This wasn't a fundamental reset; it was liquidation hitting a market grown "overconfident." Many participants were caught off-guard, leading to widespread margin calls.

The primary trigger for last week's market jitters was the escalating U.S.-China trade war, with President Trump reportedly threatening 100% tariffs on Chinese goods.

On October 13, 2025, U.S. Treasury Secretary Scott Bessent accused China of "financing war" as tensions heightened. These extreme tariffs are seen as a negotiation tactic—a threat for a blockade designed to bring China to the table.

The global economy’s reliance on Chinese goods means this war of words will persist, injecting significant short-term uncertainty.

The Unstoppable Force: AI's Enduring Arms Race

Amidst the market choppiness, the AI trade continues its relentless march.

Stocks like AMD and Nvidia have seen significant new highs, underscoring the market's conviction in this sector. Projections show continuous increasing expenditure commitments on AI spending all the way up to 2028.

|

Despite narratives of "circular investment" among major AI players, real capacity—like data centers—is being built.

The critical test arrives in the next two weeks as quarterly earnings trickle in, revealing whether app-level revenues can truly scale and justify current valuations.

This is a conviction test for the most dominant theme in modern markets.

Safe Havens and Crypto: The Great Rotation Accelerates

During the market's tremor, a clear rotation into safe assets was evident: gold, silver, and bonds all saw gains.

|

This trend aligns with the modern era of money printing, where these assets have largely outperformed risk assets, with gold historically beating all equity indices (excluding Bitcoin) since 2000.

In the crypto sphere, Bitcoin is in a bull run, fueled by ETF demand and a narrative shift towards its transparency, making it increasingly seen as the "most public chain."

🧭 Proflex Playbook – Navigating Volatility with Conviction

The recent market pullback, while unsettling for many, was a necessary correction of excess.

True financial professionals understand that risk management is paramount, not just "buying the dip" blindly.

Our stance remains clear and decisive:

- Focus on Structural Growth: Continue to overweight the secular AI theme, recognizing its multi-year runway.

- Anticipate Shallow Corrections: Use dips as accumulation opportunities, not reasons for fear, understanding that "none of the corrections stick."

- Diversify Thoughtfully: Recognize the "decorrelation" across asset classes; consider gold and Bitcoin for portfolio resilience.

- Develop Mental Models: Prioritize long-term planning (6-12 months out) over short-term news, aiming for consistent, incremental gains.

If you're an All-Access or Managed Portfolio subscriber, our positioning has already shifted ahead of this moment—scaling up asymmetric hard asset plays while hedging for earnings volatility and geopolitical tail risks.

| Proflex All-Access Subscription (Yearly) |

| Proflex All-Access Subscription (Monthly) |

Until next week,

— The Proflex Team

Trusted Macro Insights. Calm Investing. Tactical Trades.

Legal Disclosures

Blockstart Research Proflex Series

ProFlex® is designed to optimize your time, ignite your investment IQ, and maximize your financial potential.