ProFlex® is designed to optimize your time, ignite your investment IQ, and maximize your financial potential.

Proflex Wk 43 — The Big Test: MAG7 Earnings, FOMC Watch, Credit Cracks

|

Proflex Market Update - Wk 43 MAG7 Earnings | FOMC Watch | Bitcoin's Relentless Ascent "The market is dancing on a high wire: record optimism on risk assets, yet rising credit fissures whisper a warning." Last week, the US stock markets showed strong gains with record closes. The S&P 500 rose 0.7% to close at 6,791.69, hitting a new intraday high of 6,807.11. The market is basking in a perceived "goldilocks" scenario, where easing money conditions continue to propel risk assets.

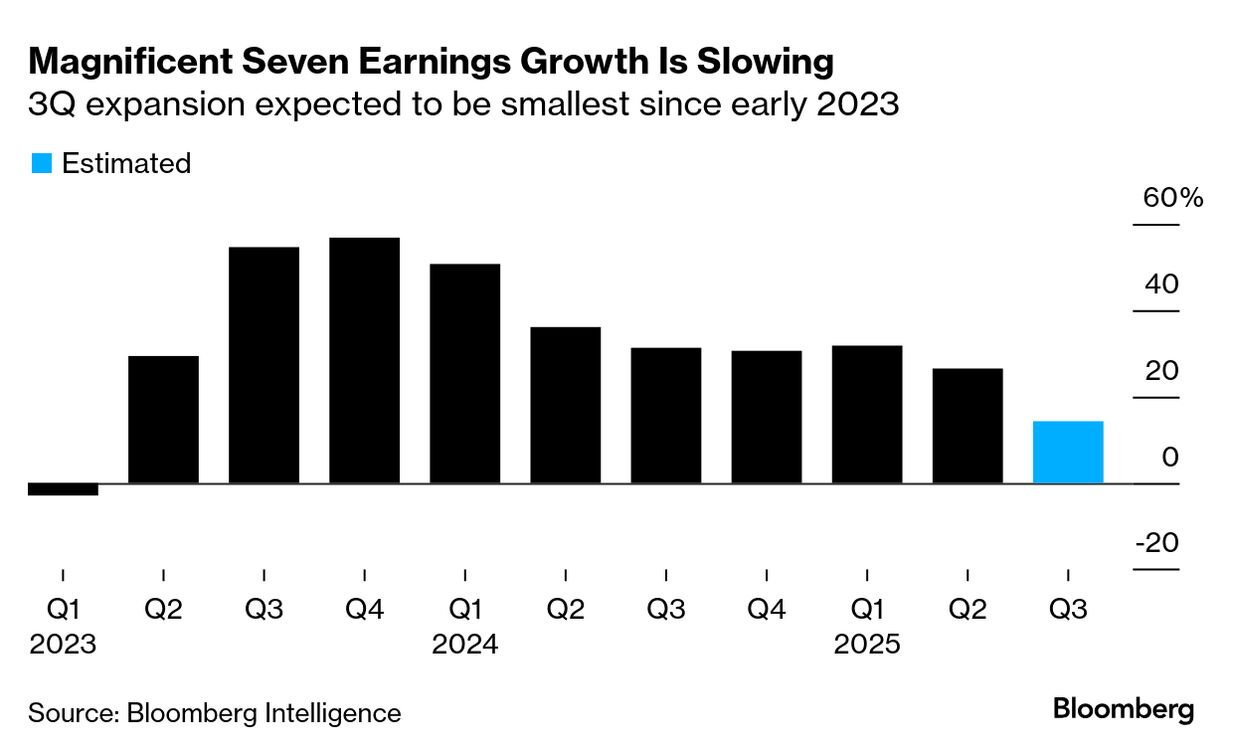

Key Drivers This Week This week presents a pivotal test for market direction. The earnings of five Magnificent Seven companies will either validate the current premium or expose cracks in the AI narrative that has powered much of the S&P's 2025 ascent.

Concurrently, the FOMC meeting on Wednesday will be scrutinized for any subtle shifts in tone regarding future monetary policy.

Proflex Takeaway: “The Mag7 test isn't just about corporate performance; it's a referendum on market psychology. Can the leaders keep leading?”

Bitcoin's Relentless Ascent & Gold's Quiet Strength While equity markets navigate earnings, Gold and Bitcoin have undeniably stolen the spotlight as top-performing assets in 2025. Gold has surged an incredible 51% YTD, while Bitcoin is up ~30%

Bitcoin, specifically, has shown remarkable resilience, trading around $113k this past weekend and earlier in October pushed above $125,000 to new all-time highs. The continued strength of these assets, often seen as safe-havens, provides a counter-narrative to the equity-driven "goldilocks" and underscores underlying inflation and uncertainty concerns.

Proflex Takeaway: “This continues to reflect a structural shift towards alternative investment cases validated by institutions. Smart money is diversifying beyond traditional equities.”

The Undeniable Creep of Credit Risk Despite market optimism, the background noise around growing credit distress is becoming louder and harder to ignore. These indicators point to potential systemic vulnerabilities being masked by current market liquidity.

“The true cost of prolonged cheap money is rarely seen until it's too late. The system has absorbed capacity, but cracks are forming.” — Proflex Risk Analytics Team While macro conditions are driving markets higher now, these underlying issues represent a critical medium-term threat that could fundamentally alter the market landscape once liquidity conditions shift or confidence wanes. We are at a critical junction where short-term momentum clashes with building medium-term risks. Navigating this environment demands a disciplined, tactical approach. Our stance remains clear and decisive:

Proflex All-Access: Your Market Compass

Explore the financial markets with Proflex All-Access, your comprehensive resource for deeper market understanding and active participation. This premium service offers subscribers exclusive insights and actionable investment advice, giving you a significant edge in various market conditions.

Proflex All-Access provides detailed analyses and recommendations to optimize your investment strategy. Our specialized newsletters include:

• Growth Gazette: Aimed at achieving above-market returns for aggressive portfolio growth.

• Income Insider: Focused on conservative strategies and income generation for yield-seeking investors.

• Crypto Pulse: Offers advanced strategies for investing in the rapidly expanding cryptocurrency market.

Until next week,

ProFlex® by Blockstart Research

Legal Disclosures ProFlex® by Blockstart Research, the premium newsletter product series, provides informational and educational content only and does not offer personalized investment advice or establish a fiduciary relationship. While we rely on reliable sources and research, the information is not tailored to individual financial situations. Readers are urged to consult qualified financial professionals before making investment decisions. We do not guarantee the accuracy, completeness, or timeliness of the information and are not responsible for any investment decisions based on this newsletter. Investing carries risks, and past performance doesn't predict future results. By accessing this newsletter, you acknowledge that we are not liable for actions or decisions resulting from its content. Please conduct due diligence and seek professional advice as needed.

|

Blockstart Research Proflex Series

ProFlex® is designed to optimize your time, ignite your investment IQ, and maximize your financial potential.