ProFlex® is designed to optimize your time, ignite your investment IQ, and maximize your financial potential.

Proflex Wk 44 — Phantom QT, Mag7 Capex, Gold's Price Discovery

|

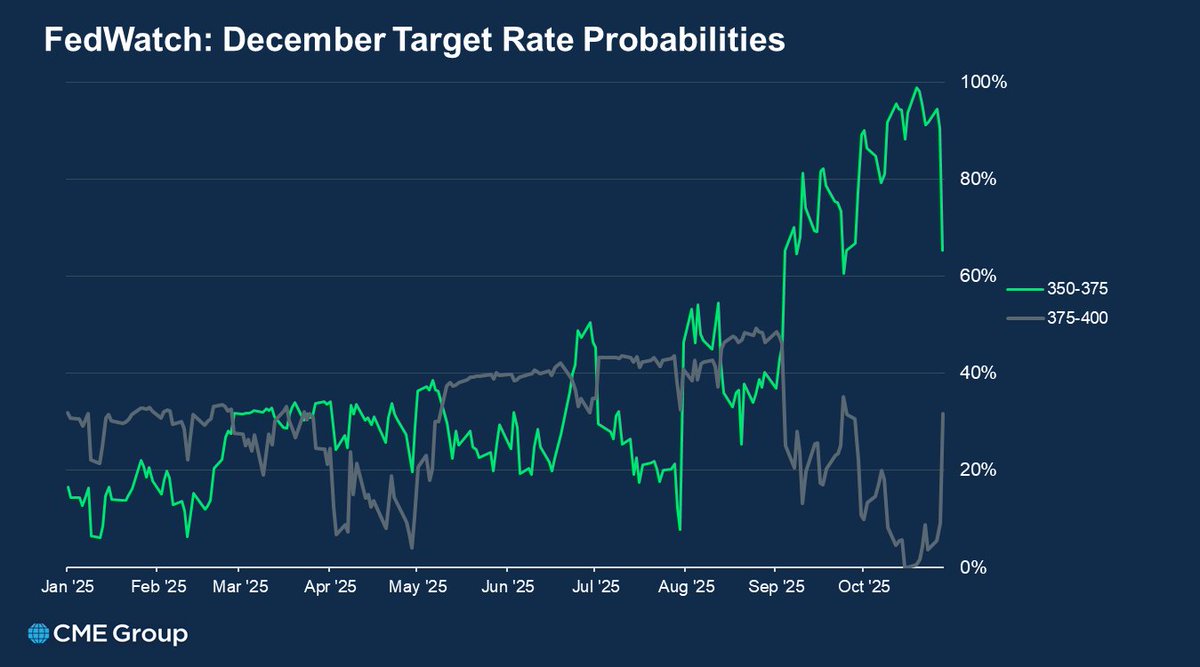

Proflex Market Update - Wk 44 Liquidity Squeeze | AI's Debt-Fueled Growth | Hard Assets' Resurgence "The market is battling a phantom QT, while the real narrative of AI and hard asset strength remains obscured by short-term noise." Last week saw the Federal Reserve cut rates for the second time this year, bringing the benchmark federal funds rate to a range of 3.75%–4.0% after an October 25-basis-point reduction.

Sophisticated investors must look beyond headline rate cuts to understand the underlying currents shaping the next market move. Insights from Proflex Macro Call

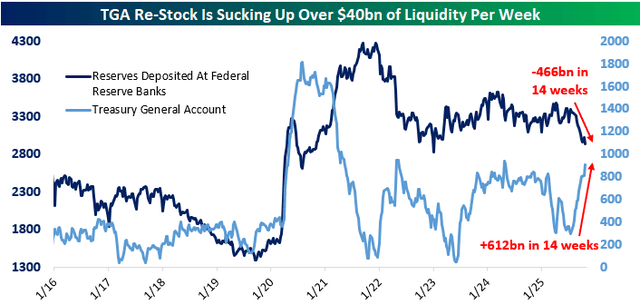

“The true ‘Quantitative Tightening’ isn’t from the Fed anymore. It’s a political side effect, quietly pulling almost a trillion dollars out of the system.” — Proflex Macro Discussion This is critical. The massive surge in the Treasury General Account (TGA) balance, now approaching a trillion dollars, is acting as a de facto Quantitative Tightening (QT), draining liquidity that would otherwise bolster banks. You can watch the complete weekly call recording here:

Key Drivers This Week The Fed’s actions this week signal a complex landscape. While the October cut was priced in, the central bank’s forward guidance remains ambiguous.

Yet, real-time indicators like the Secured Overnight Financing Rate (SOFR) are tracking higher, signaling that liquidity is drying up. The silver lining? Quantitative Tightening (QT) is officially ending on December 1st, a widely hinted move.

Proflex Takeaway: "The best the Fed could do was stop QT, which they did. The question now becomes: how long until the market demands Quantitative Easing (QE)?"

AI: From Cash-Rich Growth to Debt-Fueled Risk The underlying driver of the stock market remains the AI boom and robust capital expenditure (capex). Post-earnings calls confirmed the AI story is intact, with big spenders like Meta, Google, Amazon, and Microsoft rapidly accelerating capex, now approaching almost half a trillion dollars.

The belief that AI spending is nearing its end is simply not materializing; we are, in the speaker’s view, still in the “fourth inning” of this cycle. Monetization is now visible, with companies like Google showcasing accelerated cloud growth and cross-segment benefits. The “winners” are clear: those who can show a direct revenue impact from AI spending, primarily cloud-resellers like Microsoft, Google, and Amazon. However, a critical shift is underway: AI spending is increasingly shifting from corporate cash flow to debt funding. This escalating bond issuance increases the risk profile significantly. Hard Assets: The True Read on Liquidity Precious metals, particularly gold and silver, serve as an excellent proxy for money printing and systemic liquidity. Historical suppression of gold and silver by paper money manipulations is breaking, driven by a renewed demand for physical assets, leading to true price discovery.

Proflex Takeaway: "Smart money understands that gold and silver are steady-state accruers of store value, while risk assets like stocks and Bitcoin typically thrive in high-liquidity environments. Strategic allocation, not an either/or mentality, is paramount in this evolving landscape." The market is navigating a politically induced liquidity headwind, but the underlying structure of capital and the AI narrative remain intact. The month-end stress of October is likely to ease, paving the way for more positive fund flow in November. Our stance remains clear and decisive:

Proflex All-Access: Your Market Compass

Explore the financial markets with Proflex All-Access, your comprehensive resource for deeper market understanding and active participation. This premium service offers subscribers exclusive insights and actionable investment advice, giving you a significant edge in various market conditions.

Proflex All-Access provides detailed analyses and recommendations to optimize your investment strategy. Our specialized newsletters include:

• Growth Gazette: Aimed at achieving above-market returns for aggressive portfolio growth.

• Income Insider: Focused on conservative strategies and income generation for yield-seeking investors.

• Crypto Pulse: Offers advanced strategies for investing in the rapidly expanding cryptocurrency market.

Until next week,

ProFlex® by Blockstart Research

Legal Disclosures ProFlex® by Blockstart Research, the premium newsletter product series, provides informational and educational content only and does not offer personalized investment advice or establish a fiduciary relationship. While we rely on reliable sources and research, the information is not tailored to individual financial situations. Readers are urged to consult qualified financial professionals before making investment decisions. We do not guarantee the accuracy, completeness, or timeliness of the information and are not responsible for any investment decisions based on this newsletter. Investing carries risks, and past performance doesn't predict future results. By accessing this newsletter, you acknowledge that we are not liable for actions or decisions resulting from its content. Please conduct due diligence and seek professional advice as needed.

|

Blockstart Research Proflex Series

ProFlex® is designed to optimize your time, ignite your investment IQ, and maximize your financial potential.