ProFlex® is designed to optimize your time, ignite your investment IQ, and maximize your financial potential.

Proflex Wk 45 — Shutdown Resolution, Fed Injection, Market Reversal

|

Proflex Market Update - Wk 45 Shutdown Resolution | Liquidity Pivot | All-Asset Rally Ahead

"The market just received a liquidity injection by Fed —don't mistake recent weakness for a broken trend."

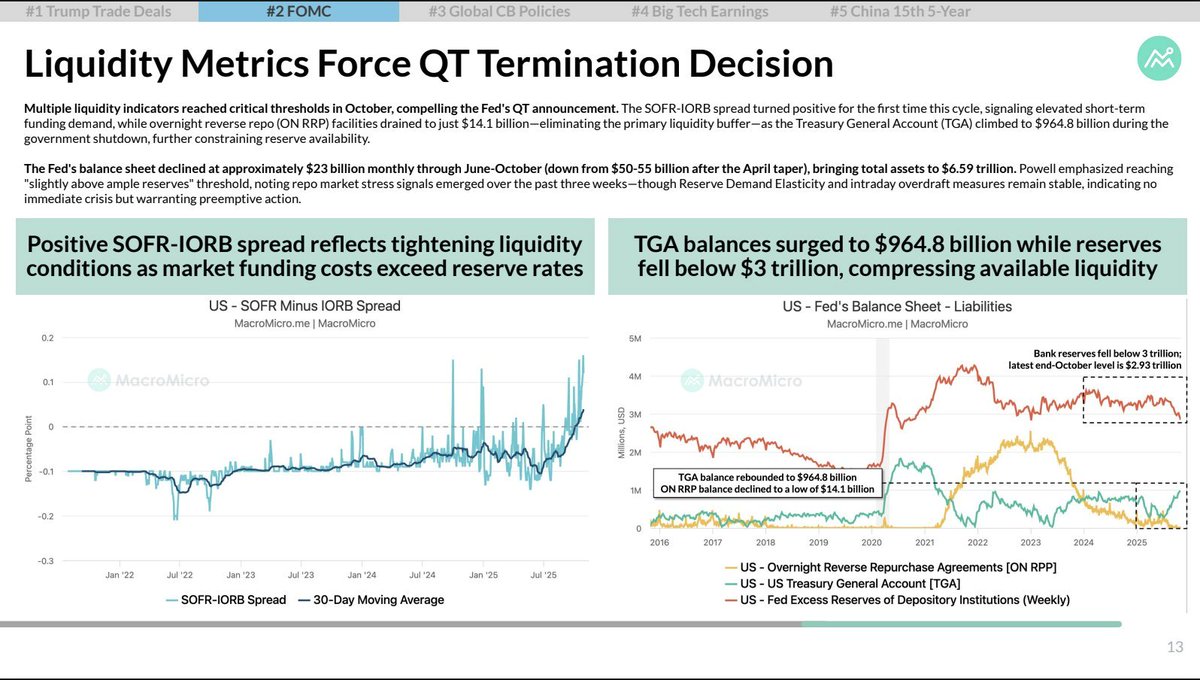

Last week's market correction, triggered by the longest government shutdown in U.S. history and a subsequent liquidity crunch, is now facing a decisive pivot.

Key Drivers This Week The 2025 government shutdown, which reached an unprecedented 35 days on November 5, caused a severe liquidity crunch and broad market correction last week.

Proflex Takeaway: "This is a credibility test for Washington—can they deliver stability that markets desperately need?" Fed's Liquidity Pivot: SRF & QT Signal a Turning Tide In parallel to the shutdown chaos, the Federal Reserve has been aggressively bolstering bank liquidity.

The New York Fed began repo operations on its new FedTrade Plus platform on November 6, 2025, indicating enhanced operational capabilities.

What this means next: We believe the market has seen the worst of the short-term liquidity crunch, setting the stage for a more accommodative environment. All-Asset Rally: Gold and Bitcoin Positioned for Renewed Interest The improving liquidity outlook and the resolution of the shutdown overhang are poised to re-ignite interest in risk assets.

Both assets often thrive in environments of expanding monetary supply and reduced systemic risk. The market is not merely recovering; it is potentially embarking on a new phase driven by restored liquidity and political stability. Our stance remains clear and decisive:

Proflex All-Access: Your Market Compass

Explore the financial markets with Proflex All-Access, your comprehensive resource for deeper market understanding and active participation. This premium service offers subscribers exclusive insights and actionable investment advice, giving you a significant edge in various market conditions.

Proflex All-Access provides detailed analyses and recommendations to optimize your investment strategy. Our specialized newsletters include:

• Growth Gazette: Aimed at achieving above-market returns for aggressive portfolio growth.

• Income Insider: Focused on conservative strategies and income generation for yield-seeking investors.

Until next week,

ProFlex® by Blockstart Research

Legal Disclosures ProFlex® by Blockstart Research, the premium newsletter product series, provides informational and educational content only and does not offer personalized investment advice or establish a fiduciary relationship. While we rely on reliable sources and research, the information is not tailored to individual financial situations. Readers are urged to consult qualified financial professionals before making investment decisions. We do not guarantee the accuracy, completeness, or timeliness of the information and are not responsible for any investment decisions based on this newsletter. Investing carries risks, and past performance doesn't predict future results. By accessing this newsletter, you acknowledge that we are not liable for actions or decisions resulting from its content. Please conduct due diligence and seek professional advice as needed.

|

Blockstart Research Proflex Series

ProFlex® is designed to optimize your time, ignite your investment IQ, and maximize your financial potential.

![The longest government shutdown in US history [OC] : r/dataisbeautiful](https://preview.redd.it/the-longest-government-shutdown-in-us-history-v0-yhyvmoueenzf1.png?auto=webp&s=8088ab57c32db34cef39ad0eeeea86190a3f9c8b)