ProFlex® is designed to optimize your time, ignite your investment IQ, and maximize your financial potential.

Proflex Wk 46 — The Liquidity Trifecta: Japan, China, TGA & the Next Market Leg

|

Proflex Market Update - Wk 46 Global Liquidity Influx | AI's Resilience | Volatility's Last Stand

"The greatest risk isn't overvaluation; it's underestimating the sheer force of incoming capital."

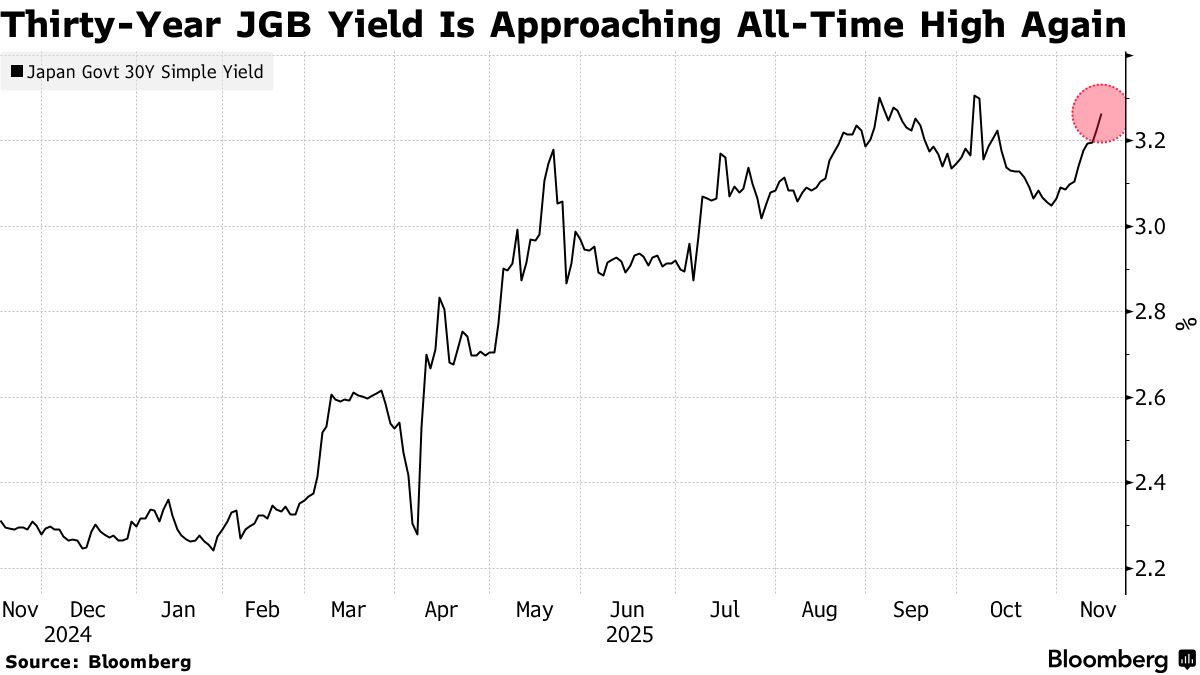

This week saw markets grapple with lingering volatility and a fractured macro picture, yet a significant wave of global liquidity is quietly positioning the next leg higher. From Japan's massive stimulus to ongoing TGA drains and aggressive Chinese injections, smart money is preparing for a new capital cycle. Insights from Proflex Macro Call

History shows that sustained capital inflows, not momentary chart patterns, dictate the next structural bull run.

"The narrative of endless tightening is dead. Policy makers have no appetite for pain, and fresh capital is always seeking an outlet." — Proflex Macro Call You can watch the complete recording here:

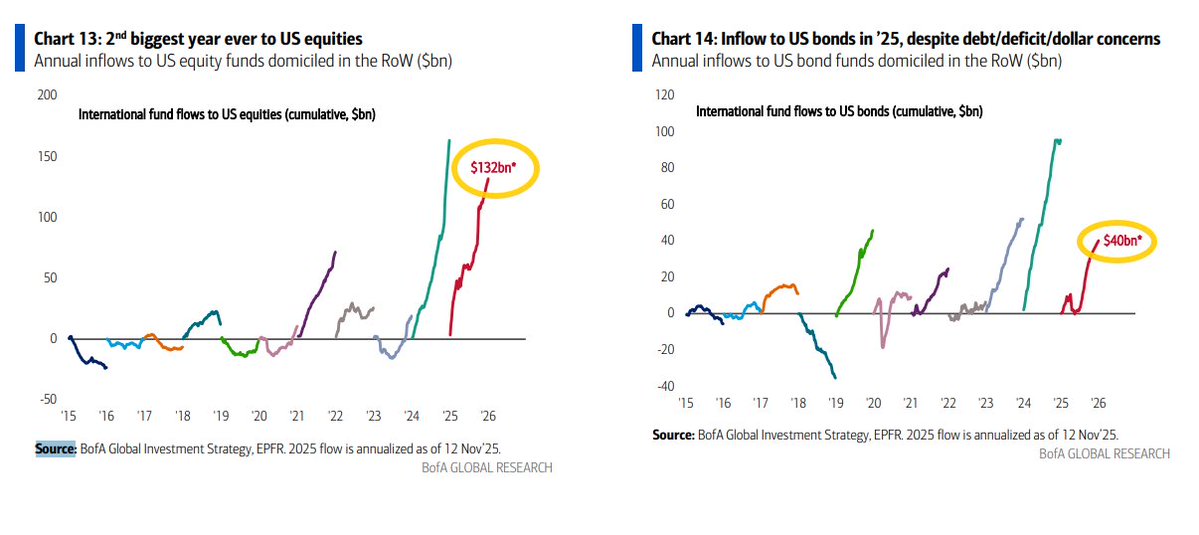

Key Drivers This Week A massive wave of capital is poised to enter the global financial system, setting the stage for significant market shifts.

Concurrently, a $300 billion TGA (Treasury General Account) drain is expected as per JP Morgan analysis, injecting substantial funds directly into the U.S. financial system.

What this means next: The market is currently sitting on low liquidity, creating volatility, but the medium to long-term macro picture suggests capital will seek favored assets. Expect a re-evaluation of rate cut probabilities as new data emerges, potentially triggering a significant market move. This is a credibility test for the Fed’s ability to navigate global easing without appearing weak. AI's Unchecked Ascent: Trusting the Builders, Not the Bears The "AI bubble" debate continues to rage, but smart money is positioning with conviction. Real monetization is evident: Google is expanding, hyperscalers aren't pulling back, and demand for APIs (OpenAI, Anthropic) remains robust.

The rising spreads on tech debt are merely the credit market's historical skepticism, mirroring early AWS investments—not a sign of an impending bust. The Proflex view is clear: trust the hyperscalers and industry giants who are investing billions in the system, not the perennial market shorts. Bitcoin's Resilience Amidst Volatility: Macro Support Intact Bitcoin experienced a steeper correction this week, technically rejecting the 200-day moving average.

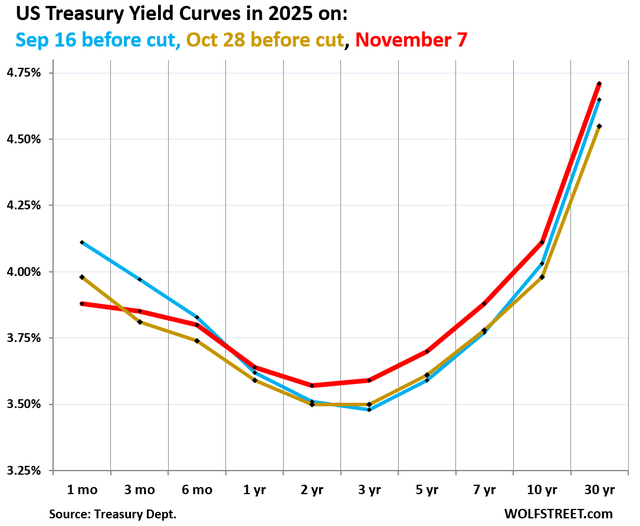

Proflex emphasizes that the ending of Quantitative Tightening (QT), coupled with an increasing global money supply and expected lower interest rates, provides a powerful tailwind for digital gold. Macro Crosscurrents: Fed, Yields, and the Slowing Economy The market is currently navigating a maze of conflicting macro signals. The probability of a December Fed rate cut has plummeted from 95% a month ago to 45%, largely due to post-blackout Fed commentary and delayed economic data.

This signals a contrarian view: macro still favors lower rates ahead, and the market isn't truly concerned about runaway inflation. "Main street" economic slowdown since 2022, coupled with rising unemployment outside the AI boom, dictates that policymakers have no appetite for pain. Short-term liquidity crunch and high leverage are creating volatility, but the medium to long-term macro picture is solid. Our stance remains clear and decisive:

Proflex All-Access: Your Market Compass

Explore the financial markets with Proflex All-Access, your comprehensive resource for deeper market understanding and active participation. This premium service offers subscribers exclusive insights and actionable investment advice, giving you a significant edge in various market conditions.

Proflex All-Access provides detailed analyses and recommendations to optimize your investment strategy. Our specialized newsletters include:

• Growth Gazette: Aimed at achieving above-market returns for aggressive portfolio growth.

• Income Insider: Focused on conservative strategies and income generation for yield-seeking investors.

• Crypto Pulse: Offers advanced strategies for investing in the rapidly expanding cryptocurrency market.

Until next week,

ProFlex® by Blockstart Research

Legal Disclosures ProFlex® by Blockstart Research, the premium newsletter product series, provides informational and educational content only and does not offer personalized investment advice or establish a fiduciary relationship. While we rely on reliable sources and research, the information is not tailored to individual financial situations. Readers are urged to consult qualified financial professionals before making investment decisions. We do not guarantee the accuracy, completeness, or timeliness of the information and are not responsible for any investment decisions based on this newsletter. Investing carries risks, and past performance doesn't predict future results. By accessing this newsletter, you acknowledge that we are not liable for actions or decisions resulting from its content. Please conduct due diligence and seek professional advice as needed.

|

Proflex Institutional Research Series

ProFlex® is designed to optimize your time, ignite your investment IQ, and maximize your financial potential.