ProFlex® is designed to optimize your time, ignite your investment IQ, and maximize your financial potential.

Proflex Wk 47 — AI Valuations, September Jobs, Expiry Volatility

|

Proflex Market Update - Wk 47 Mixed Jobs Data | AI Test | Expiry Volatility The past week delivered a potent mix of economic cooling and market recalibration. Against this backdrop, global liquidity continues to quietly dominate. Historically, peaks in global rate cuts overlap with the most powerful equity cycles — a trend now appearing again. The December FOMC will be the market’s critical junction. With QT ending, disinflation visible, and policy becoming more accommodative, this meeting will shape expectations for 2026.

Key Drivers This WeekMacro Shift & Fed's New Tone The delayed September jobs report finally landed, painting a picture of a cooling labor market. Crucially, inflation data remained constrained, with the October CPI cancelled. This means the Fed heads into the December 9–10 FOMC meeting without fresh inflation figures, relying heavily on the sticky September CPI at 3.0% YoY and the evolving employment picture. A clear dovish shift emerged from Fed officials by week’s end. NY Fed President John Williams openly discussed a December rate cut, citing risks tilted towards employment weakness.

All Eyes on Fed: Can they orchestrate a soft landing amidst clear signs of economic deceleration and persistent inflation pockets without reigniting price pressures? The next two weeks are critical for policy decision.

AI Sector Update: Nvidia’s Beat, Healthy Reset After Euphoria Nvidia delivered another flawless quarter — a major beat on both revenue and EPS, with Data Center growth remaining exceptionally strong and Blackwell demand still far above supply.

Q4 guidance came in meaningfully ahead of expectations, reaffirming that the AI capex cycle remains nowhere near peaking. Yet despite the strength, NVDA slipped the next day. This wasn’t about fundamentals — it was the market digesting stretched valuations and the impact of the $3T options expiry positions as well as algorithmic resets. This pullback looks more like a valuation reset than a change in narrative, a necessary breather after months of one-way upside.

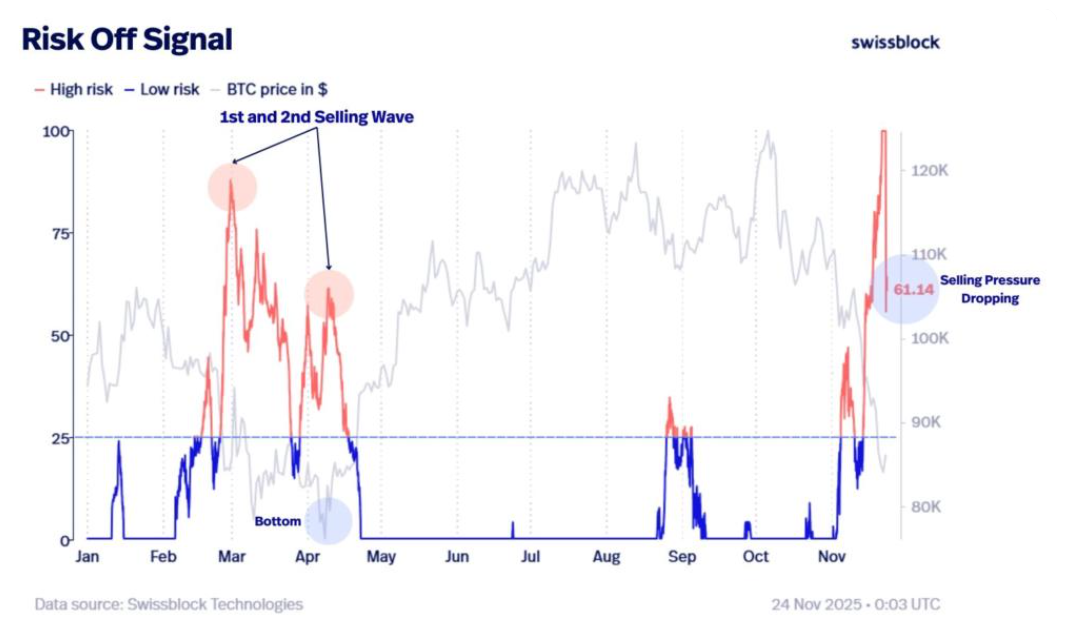

Proflex Takeaway: Nvidia’s fundamentals remain strong. The post-earnings dip reflects positioning, not deterioration. The AI capex engine is still accelerating, making this correction a healthy reset in a powerful multi-year cycle. Bitcoin Update: Sharp Correction with Critical Inflection Point Bitcoin endured a sharp correction this week, sliding from the $100K+ zone into the 80-85Ks.

Sovereign adoption continues to stay steady, with EM central banks and state funds gradually increasing BTC exposure as part of their long-term reserve diversification. Crucially, sentiment washed out: positioning, leverage, and funding flipped from overheated to reset territory. When BTC sells off on already-known catalysts (Mt. Gox, USD strength, AI correction), it often signals peak pessimism being priced in, not new downside.

Proflex Takeaway: With sovereign adoption rising, liquidity turning supportive globally, and sentiment reset, Bitcoin’s long-term setup remains one of the strongest across all global assets. We are at a critical inflection point where central bank dovishness meets genuine economic deceleration and stretched valuations. Our stance remains clear and decisive:

Proflex All-Access: Your Market Compass

Explore the financial markets with Proflex All-Access, your comprehensive resource for deeper market understanding and active participation. This premium service offers subscribers exclusive insights and actionable investment advice, giving you a significant edge in various market conditions.

Proflex All-Access provides detailed analyses and recommendations to optimize your investment strategy. Our specialized newsletters include:

• Growth Gazette: Aimed at achieving above-market returns for aggressive portfolio growth.

• Income Insider: Focused on conservative strategies and income generation for yield-seeking investors.

• Crypto Pulse: Offers advanced strategies for investing in the rapidly expanding cryptocurrency market.

Until next week,

ProFlex® by Blockstart Research

Legal Disclosures ProFlex® by Blockstart Research, the premium newsletter product series, provides informational and educational content only and does not offer personalized investment advice or establish a fiduciary relationship. While we rely on reliable sources and research, the information is not tailored to individual financial situations. Readers are urged to consult qualified financial professionals before making investment decisions. We do not guarantee the accuracy, completeness, or timeliness of the information and are not responsible for any investment decisions based on this newsletter. Investing carries risks, and past performance doesn't predict future results. By accessing this newsletter, you acknowledge that we are not liable for actions or decisions resulting from its content. Please conduct due diligence and seek professional advice as needed.

|

Blockstart Research Proflex Series

ProFlex® is designed to optimize your time, ignite your investment IQ, and maximize your financial potential.