ProFlex® is designed to optimize your time, ignite your investment IQ, and maximize your financial potential.

Proflex Wk 48 — Japan’s 2008-Level Yields, Fed Pivot Momentum, 2026 Outlook

|

Proflex Market Update - Wk 48 Japan Yield Shock | Fed Cut Back in Play | Dec 2025 Outlook “The market is holding its breath. What appears calm on the surface masks a rising tide of global tension.” Last week, markets defied lingering anxieties, showing resilience with a notable uptick despite thin, holiday-week volumes.

Key Drivers This Week

|

|

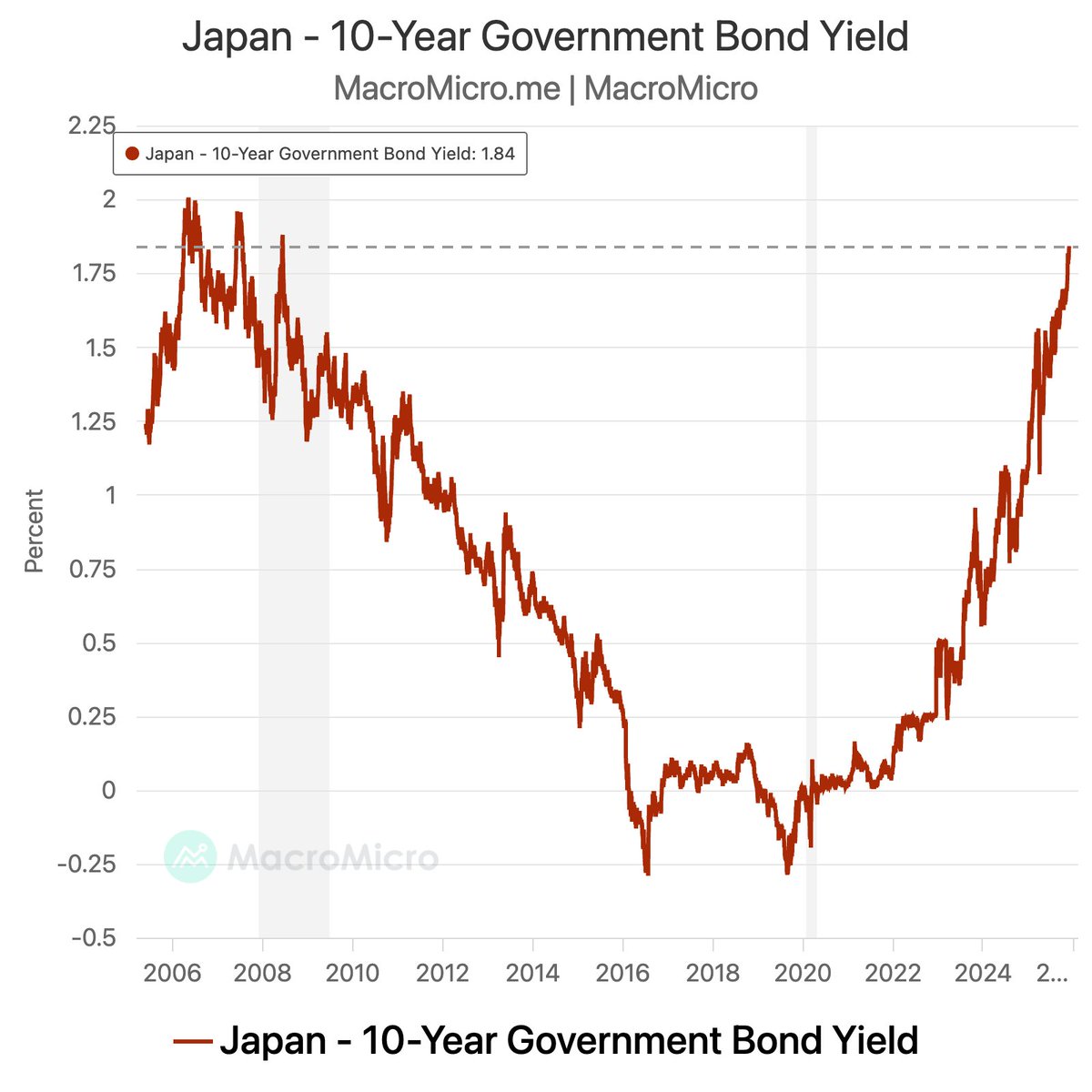

The yield chart is concerning to say the least, signalling potential liquidity pressure for global markets.

A potential rate hike in Japan remains the main news point the market might be underpricing. Any unwinding of the long-standing Yen carry trade due to rising domestic yields could ripple through international funding markets, impacting assets leveraged globally.

Investors must recognize that rising Japanese yields directly cause liquidity pressure elsewhere. This is a market structure test.

The Fed Pivot: December Rate Cut Hopes Resurface

The odds of a Federal Reserve interest rate cut in December have surged dramatically, moving from a mere 30% probability just weeks ago to above 80% on prediction markets.

|

This sudden shift indicates a powerful consensus forming on Wall Street. A cut would likely bring the target federal funds rate to a range of 3.50%-3.75%, a significant move after more than a year of holding steady.

This pivot isn't happening in isolation; it coincides with the effective end of Quantitative Tightening (QT) and renewed discussions around flexible bank Supplemental Leverage Ratio (SLR) requirements, both of which promise to inject substantial liquidity back into the financial system.

This coming week will be a critical inflection point, as the Fed's stance will dictate not just short-term sentiment but the market's trajectory well into Q1 2026.

AI Bubble Debate & NVDA Under Scrutiny

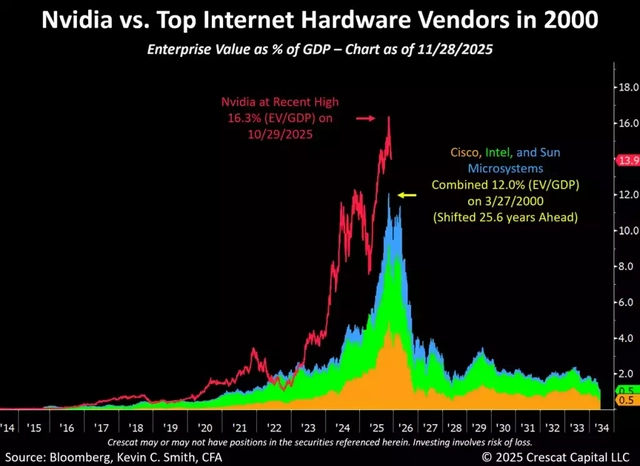

Concerns surrounding a potential AI bubble, particularly centered on NVIDIA (NVDA), continue to bug the market.

The company itself felt compelled to issue an official statement clarifying that it is "not Enron," a direct response to growing skepticism.

|

Notorious shorts like Michael Burry and Jim Chanos are aggressively pushing the narrative that the AI story is dead, likening it to past tech bubbles. While panic around "bubble discussions" is palpable, we at Proflex view much of this as propaganda from shorts.

The fundamental demand for AI infrastructure remains robust, and the innovation cycle is far from exhausted.

The NVDA narrative is a proxy for broader market confidence in growth stocks. While a short-term shakeout might occur as markets find their footing, the underlying technological shift powered by AI is profound.

Precious Metals Rally & The 2026 Outlook

Amidst the shifting narratives, Gold and Silver have broken out from their consolidation phases, signaling a broader return of liquidity to the market.

Why? Chinese precious-metal inventories have collapsed. Silver is down to 715 tonnes, its lowest since 2016, and gold has dropped -83% from 2021 highs to the weakest levels since 2015.

|

The squeeze is being driven by record exports to London, where shortages are pulling metal out of China. October alone saw 660 tonnes of gold exported — the highest ever — pushing both gold and silver into historic territory.

Furthermore, the market is beginning to price in a "Santa Claus rally" for the end of the year, with analysts already looking ahead to a robust 2026. Deutsche Bank, for instance, predicts the S&P 500 will finish 2026 at 8000, representing a 17% jump from recent closes.

The rally in precious metals and optimistic 2026 forecasts suggest a deeper capital rotation is underway.

Investors are seeking both safe-haven assets and growth opportunities, reflecting a nuanced confidence in a new, more accommodative monetary environment.

This dual-pronged rally signifies a belief in sustained market gains beyond just the tech sector.

🧭 Proflex Playbook – Stay Agile, Stay Alert

We are at a critical inflection point where central bank dovishness meets genuine economic deceleration and stretched valuations.

The market's recent rally was built on thin air, but new liquidity and a potential Fed pivot offer a complex, yet actionable, landscape.

Our stance remains clear and decisive:

- Focus on Structural Growth: Continue to overweight the secular AI theme, recognizing its multi-year runway.

- Anticipate Shallow Corrections: Use dips as accumulation opportunities, not reasons for fear, understanding that "none of the corrections stick."

- Diversify Thoughtfully: Recognize the "decorrelation" across asset classes; consider gold and Bitcoin for portfolio resilience.

- Develop Mental Models: Prioritize long-term planning (6-12 months out) over short-term news, aiming for consistent, incremental gains.

If you're an All-Access or Managed Portfolio subscriber, our positioning has already shifted ahead of this moment—scaling up asymmetric hard asset plays while hedging for earnings volatility and geopolitical tail risks.

| Proflex All-Access Subscription (Yearly) |

| Proflex All-Access Subscription (Monthly) |

Until next week,

— The Proflex Team

Trusted Macro Insights. Calm Investing. Tactical Trades.

Legal Disclosures

Blockstart Research Proflex Series

ProFlex® is designed to optimize your time, ignite your investment IQ, and maximize your financial potential.