ProFlex® is designed to optimize your time, ignite your investment IQ, and maximize your financial potential.

Proflex Wk 49 — FOMC, Oracle Earnings, Crypto Whale

|

Proflex Market Update - Wk 49 Rate Cuts Imminent | Oracle Earnings | Crypto's New Whale “Liquidity is the arbiter of asset prices. Dismissing valuation noise, markets are now repositioning for an inevitable monetary shift.” The market’s V-shaped recovery continues, fueled by a renewed flush of liquidity and the impending Federal Reserve rate cuts, now priced in with high conviction.

While tech giants grapple for AI supremacy, the crypto space braces for new institutional players and a potential shake-up. Insights from the Proflex Macro CallOne of the most overlooked insights this week: the market's current trajectory is a testament to liquidity maximalism, not traditional valuation metrics.

“The market doesn't care about your valuation models when the floodgates of liquidity are open. It cares about the flow.” — Proflex Macro Discussion

Proflex views different asset classes not as mere instruments but as proxies for specific geopolitical and economic "stories": Gold signals Chinese de-dollarization, Bitcoin hedges against infinite money supply, and the S&P 500 bets on US technological hegemony.

Key Drivers This Week

|

|

The main focus for investors will be the FOMC's upcoming dot plot projections for 2026.

AI Leadership in Flux: Oracle's Critical Role

Unlike previous rallies, this recovery shows tech sector divergence. The market is aggressively resetting around "who will be the leader in AI."

While the S&P 500 soars, key Magnificent 7 stocks like Nvidia and Microsoft are struggling to reach all-time highs.

Capital is rotating towards Google as its Gemini 3 rollout has "won over a lot of people," perceived as undervalued with a superior full-stack advantage.

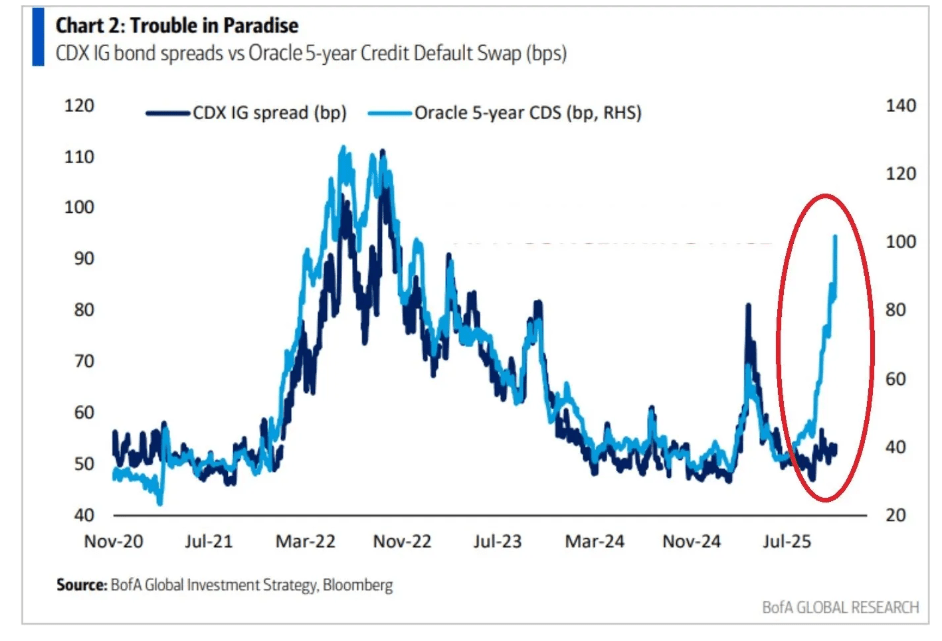

This week, Oracle announcing earnings on December 10th is a critical event.

Oracle’s credit stress is a red flag because it signals rising funding risk—making their upcoming earnings a critical test of whether this pressure is company-specific or a bottleneck of the broader tech-credit tightening.

|

The Street is watching closely, using Oracle as a "proxy for the first to fall" in the AI narrative by short sellers.

Despite sentiment deterioration, strong performance could significantly brighten the AI mood.

Crypto: Old War, New Whale

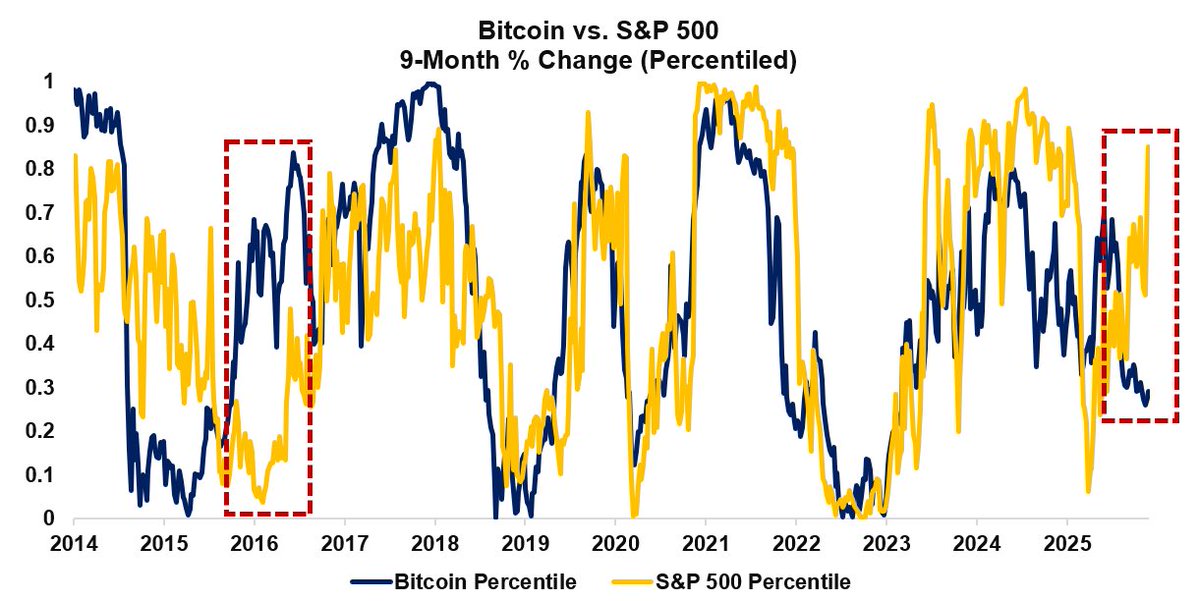

Bitcoin's failure to mirror the stock market's V-shaped recovery was not a fundamental flaw, but rather an "institutional war".

|

Big banks "fought back" against digital asset treasury companies like MicroStrategy, launching negative campaigns and shorting to redirect institutional inflows to their own ETFs.

This "cleansing" liquidated over-leveraged players and 174 copycat companies, but MicroStrategy has stabilized.

The good news? This phase is largely over.

Even more critically, a "new whale in town" — XXI — is set to begin trading next week, starting with a huge Bitcoin treasury and repeating the "Saylor playbook."

This move is expected to significantly support the Bitcoin ecosystem and validates its long-term story as a diversifier against infinite money supply.

Macro Currents: Gold, Yields, and De-dollarisation

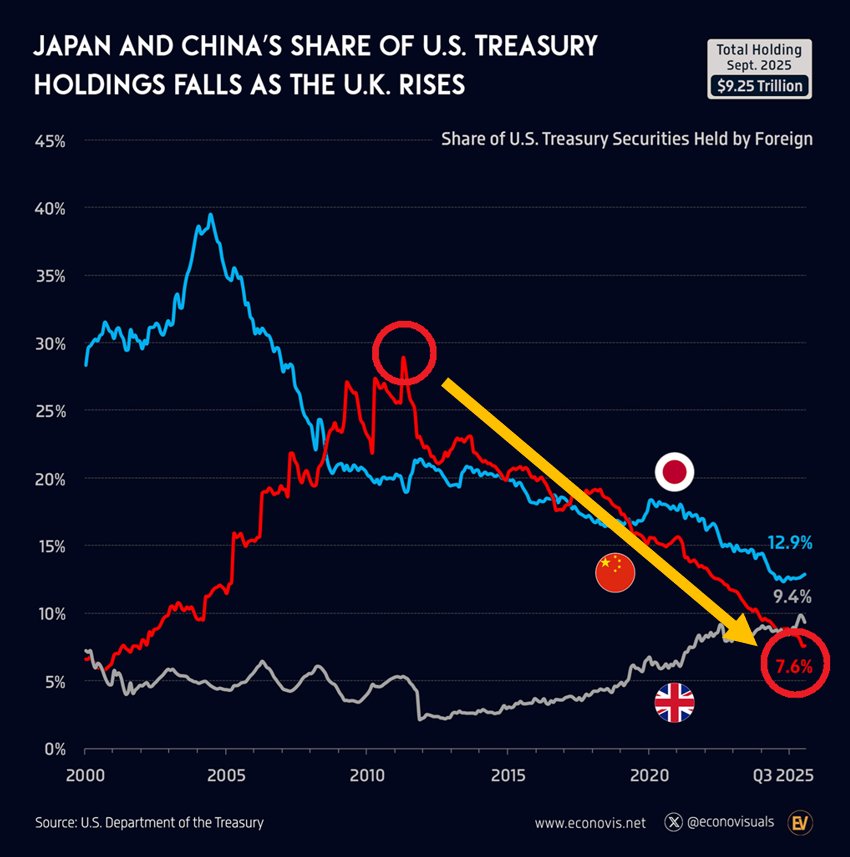

Precious metals are rallying, driven less by retail speculation and more by profound geopolitical shifts.

Gold has broken out, and silver is now outperforming in a "catch-up" trade, signaling the China de-dollarisation story.

China is reportedly following Russia's playbook, dumping US Treasuries to acquire gold as a reserve asset. This macro-driven demand will keep gold strong until China concludes its offloading.

|

On the bond front, rising long-term yields remain a concern, testing the "secondary slope" of the trend.

We are closely watching the 4.2% and 4.3% levels on the 10-year yield; a breach could threaten the broader market rally.

Conversely, fears surrounding the Yen carry trade have largely subsided, with the market absorbing news of Japan's potential rate hikes without the feared disorderly unwinding.

🧭 Proflex Playbook – Position for the Inevitable

The market is not breaking down; it is recalibrating for new liquidity dynamics and a shifting technological landscape.

Our stance remains firmly anchored in the data, dismissing the noise from "doom and gloom" narratives:

- Focus on Structural Growth: Continue to overweight the secular AI theme, recognizing its multi-year runway.

- Anticipate Shallow Corrections: Use dips as accumulation opportunities, not reasons for fear, understanding that "none of the corrections stick."

- Diversify Thoughtfully: Recognize the "decorrelation" across asset classes; consider gold and Bitcoin for portfolio resilience.

- Develop Mental Models: Prioritize long-term planning (6-12 months out) over short-term news, aiming for consistent, incremental gains.

If you're an All-Access or Managed Portfolio subscriber, our positioning has already shifted ahead of this moment—scaling up asymmetric hard asset plays while hedging for earnings volatility and geopolitical tail risks.

| Proflex All-Access Subscription (Yearly) |

| Proflex All-Access Subscription (Monthly) |

Until next week,

— The Proflex Team

Trusted Macro Insights. Calm Investing. Tactical Trades.

Legal Disclosures

Blockstart Research Proflex Series

ProFlex® is designed to optimize your time, ignite your investment IQ, and maximize your financial potential.