ProFlex® is designed to optimize your time, ignite your investment IQ, and maximize your financial potential.

Proflex Wk 50 — Hawkish Cut + QE, Oracle, Bitcoin Reset

|

Proflex Market Update - Wk 50 Hawkish Cut & QE | Oracle Earnings | Bitcoin Reset Last week, markets rallied following the Federal Reserve's December 10 rate cut, pushing SPX to near all-time highs.

Beneath the surface, macroeconomic cracks are widening—employment is deteriorating, inflation remains above target, and trillion-dollar AI investments along with Oracle's earnings disappointment face scrutiny on ROI. Proflex Informals: Thank you for Joining Us!

|

Thank you to everyone who joined us and made these meetups special throughout the year!

Wishing you and your families a wonderful holiday season and a great start to the new year. We will be hosting another event in January, so stay tuned.

|

Proflex Investor Day | Thank You for a Stellar Investor Day Weekend! First and foremost, a huge thank you to everyone who joined us for our first Investor Day of the year over the weekend! The energy, questions, and genuine interest in understanding markets made it an incredible experience for us. This was our biggest gathering yet — a true reflection of the growing strength of this community. Special shoutout to all of you who’ve been recommending Proflex to friends, family, and colleagues — it’s the strongest endorsement we could ask for. We’re committed to continuing to build something meaningful together, one thoughtful conversation at a time.

|

Key Drivers This Week

Fed Cuts Rates, Then Buys Bonds: The Stealth Stimulus

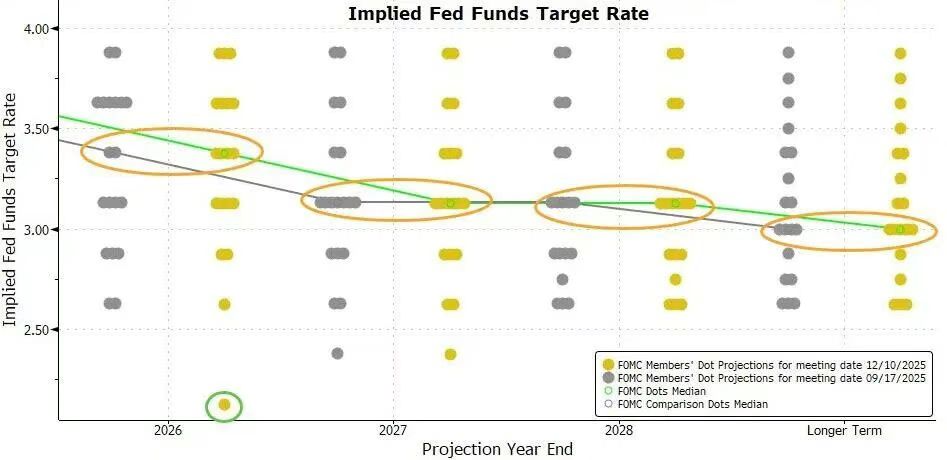

The Federal Reserve delivered its third consecutive 25 basis point rate cut, bringing the federal funds rate to 3.50%-3.75%.

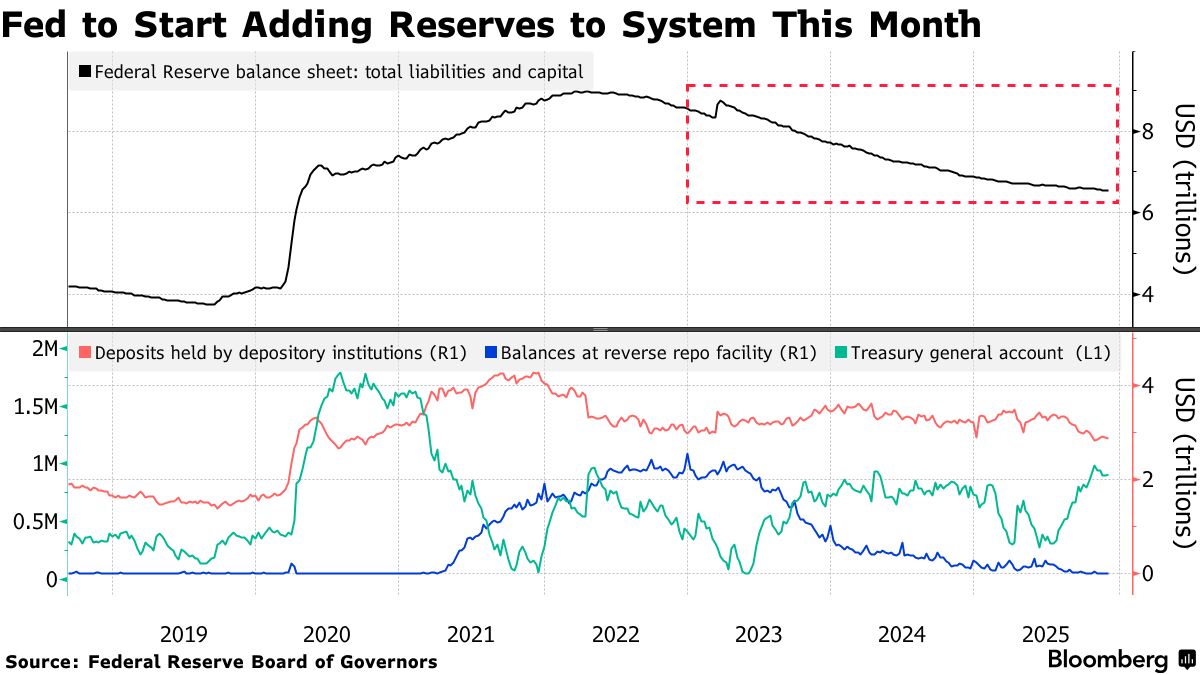

This move, however, was swiftly followed by the announcement of $40 billion in Treasury bill purchases per month starting December 12.

|

Chair Powell called it "reserve management," but investors are reading it as quasi-QE.

Post the announcement, the Dow surged, hitting a new all-time high, Yet, the S&P 500 gained just 0.2% and the Nasdaq fell 0.3%, dragged down by Oracle's disappointing guidance.

This bifurcation signals that while liquidity is repricing the market, mega-cap tech faces a harsh valuation reality.

AI Valuations & Oracle Earnings: The Conviction Test

Big Tech is on a capital spending spree defying precedent. 2025 AI-related CapEx reached $405 billion—62% higher than initial forecasts.

Oracle's earnings showed cloud infrastructure revenue up 68% to $4.1B, yet shares sold off on guidance concerns, with its P/E implying overvaluation.

|

Despite Oracle’s official denial, multiple credible reports indicate some data centers for OpenAI have been delayed to 2028 from 2027 due to labor and material shortages.

This has sparked investor concerns and dragged Oracle’s stock lower, serving as a key test for the AI infrastructure narrative.

|

If CapEx growth decelerates next quarter—or if ROI disappoints—valuations could compress sharply. The Magnificent Seven’s rally assumed infinite capital deployment; if that thesis breaks, January 2026 could deliver a repricing.

AI spending is becoming a return-on-capital test. Markets will soon stop rewarding CapEx headlines and start demanding proof as the AI trade matures.

Hard Assets & Bitcoin: De-Dollarization and the Institutional Reset

Gold is again near all-time highs as China reduces U.S. Treasury exposure and accelerates gold accumulation, reinforcing the de-dollarization trend. Silver outperformed signaling modest risk-on sentiment and improving industrial demand.

|

Crude oil remains weak, with WTI around $61/barrel, down year-over-year. OPEC+ maintaining production has kept the market oversupplied, preventing oil from participating in the broader hard-asset move.

Bitcoin traded around $89,940 on December 15 after liquidation-driven pressure.

This divergence from equities reflects institutional positioning, not fundamental weakness.

With Twenty One Capital (XXI) listing on the NYSE and transferring over 43,500 BTC into its treasury, institutional demand is re-emerging as Bitcoin continues its transition into a reserve-asset role.

De-dollarization is expressing itself across gold, silver, and Bitcoin simultaneously. Expect these assets to stay supported as institutional and sovereign capital reallocates away from fiat risk for the short-term.

🧭 Proflex Playbook – Positioning for Q1 2026

We are at a critical inflection point. The market isn't breaking down; it is recalibrating. Liquidity maximalism has driven the rally, but fundamentals (employment, inflation, AI ROI) are diverging.

The winners of 2026 will be those who recognize this inflection and rotate accordingly.

Our conviction stays anchored in the data:

- Focus on Structural Growth: Continue to overweight the secular AI theme, recognizing its multi-year runway.

- Anticipate Shallow Corrections: Use dips as accumulation opportunities, not reasons for fear, understanding that "none of the corrections stick."

- Diversify Thoughtfully: Recognize the "decorrelation" across asset classes; consider gold, silver and Bitcoin for portfolio resilience.

- Develop Mental Models: Prioritize long-term planning (6-12 months out) over short-term news, aiming for consistent, incremental gains.

If you're an All-Access or Managed Portfolio subscriber, our positioning has already shifted ahead of this moment—scaling up asymmetric hard asset plays while hedging for earnings volatility and geopolitical tail risks.

| Proflex All-Access Subscription (Yearly) |

| Proflex All-Access Subscription (Monthly) |

Until next week,

— The Proflex Team

Trusted Macro Insights. Calm Investing. Tactical Trades.

Legal Disclosures

Proflex Institutional Research Series

ProFlex® is designed to optimize your time, ignite your investment IQ, and maximize your financial potential.